Rowan Companies Has Highest Backlog among its Peers

Overall, Rowan Companies (RDC) has a comparatively stronger backlog. Higher backlogs are associated with stable revenues in the short to midterm, which reduces risk for investors.

Sept. 29 2015, Updated 5:47 a.m. ET

Backlog

Revenue backlog for offshore drilling (OIH) companies includes contracts on rigs currently working as well as any rigs already contracted for future use. Backlog is calculated as the predetermined contracted day rate multiplied by the remaining contract duration. A company’s backlog often indicates where future revenues of the company might be. It also gives us an idea of how many rigs are contracted and how many are exposed to the spot market.

Total backlog

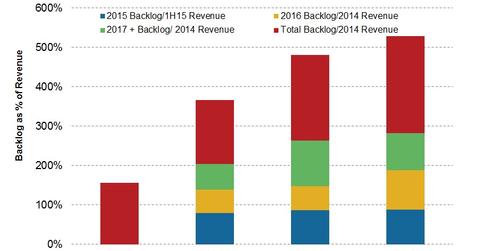

To compare backlogs across the companies in this series, we have calculated the total backlog reported at the end of 2Q15 as a percentage of total 2014 revenue. Rowan Companies (RDC) has the highest percentage at 246%, while Seadrill (SDRL) has the lowest percentage at 156%. Ensco (ESV) and Diamond Offshore (DO) came in at 162% and 217%, respectively. We will also compare yearly backlogs to gain revenue visibility for the upcoming quarters.

2015 backlog

We have calculated the ratio of backlog for the remaining half of the year as a percentage of revenue in first half of the year. This ratio tells us the companies’ revenues for second half of 2015 as compared to the first half of 2015, provided these companies fail to acquire new contracts for the next two quarters and the existing contracts remain unchanged.

Seadrill (SDRL) does not provide a yearly breakdown of its backlog in quarterly reports. Rowan Companies (RDC) also had the highest percentage in this category at 88%. This means that in the worst case scenario, if Rowan Companies is not able to add new contracts, there will be a variability of around 12% in 2H15 revenues compared to 1H15 revenues if existing contracts remain unchanged. Similarly, Diamond Offshore (DO) and Ensco (ESV) have variability of 14% and 21%, respectively, in 2H15 revenues compared to their 1H15 revenues, as their backlog percentages stand at 86% and 79%, respectively. 2H15 backlog compared to 2014 revenue stands at 37%, 39%, and 51%, for Ensco, Diamond Offshore, and Rowan Companies, respectively.

2016 backlog

The ratio of 2016 backlog to 2014 revenue stands at 100%, 61%, and 60%, for Rowan Companies (RDC), Diamond Offshore (DO), and Ensco (ESV), respectively.

Investors should keep in mind these backlogs can change over time due to new contracts and negotiations of existing contracts. Overall, Rowan Companies (RDC) has a comparatively stronger backlog. Higher backlogs are associated with stable revenues in the short to midterm, which reduces risk for investors.