Which Offshore Driller Is the Most Leveraged?

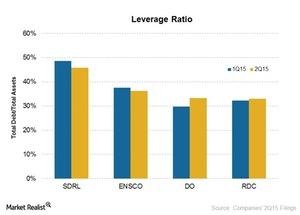

As the above chart shows, Seadrill (SDRL) has the highest leverage, with a debt-to-asset ratio of 46%. Ensco (ESV) has the second highest ratio at 36%.

Sept. 28 2015, Published 2:24 p.m. ET

Leverage ratio

Offshore drilling (XLE) companies are capital intensive, so looking at their financial leverage is of utmost importance for investors. The debt-to-asset ratio is an indicator of the financial leverage of these companies. This ratio tells us the percentage of assets financed by debt. A higher ratio means higher financial leverage and indicates higher financial risk.

Positives and negatives of debt

Debt acts as a lever, magnifying both gains and losses. Companies that have high debt in poor times have a greater chance of going bankrupt, but high leverage can also be positive if those companies do survive. Debt has a fixed cost, and with an increase in revenue, profits increase by a higher percentage. Also issuing debt instead of equity does not dilute shareholders. The cost of debt interest is a tax-deductible expense, which reduces a company’s tax burden.

As the offshore drilling environment remains challenged—most of companies’ management expects this situation to continue for the next one or two year—it is better for companies to try to reduce their debt in the total capital structure. Seadrill’s (SDRL) and Ensco’s (ESV) debt-to-asset ratio has decreased since last quarter, whereas Diamond Offshore’s (DO), and Rowan Companies’s (RDC) leverage ratios have increased.

Comparing companies on leverage

As the above chart shows, Seadrill (SDRL) has the highest leverage, with a debt-to-asset ratio of 46%. A higher leverage indicates greater financial risk. For riskier companies, investors generally demand a higher return on capital, both debt and equity. Ensco (ESV) has the second highest ratio at 36%, followed by Diamond Offshore (DO) and Rowan Companies (RDC), both of which have a debt ratio of 33%.

Seadrill has postponed its 15 newbuild deliveries, a few in 2016 and others in 2017. At the time of deliveries, the company will incur a huge capital expenditure and may need to raise additional debt to finance it. Similarly, Diamond Offshore’s (DO) projected capital expenditure far exceeds its cash obtained from operations, which suggests the company may need to resort to debt financing. Over the next 12 months, Rowan Companies’s (RDC) management expects to fund its cash requirements, including capital expenditure and debt service, from available cash and cash obtained from operating activities.