France’s Manufacturing and Service Sectors Expanded Moderately

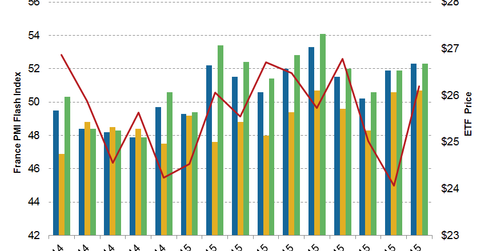

With manufacturing and services both recording growth in October, France’s composite output flash index rose to 52.3 in October compared to 51.9 in September.

Nov. 20 2020, Updated 2:56 p.m. ET

France’s composite flash index is 52.3 in October

A timely report on manufacturing helps investors gauge the business sentiment surrounding economic activities. With manufacturing and services both recording growth in October, France’s composite output flash index rose to 52.3 in October compared to 51.9 in September.

EWQ rose with an overall rebound in the economy

In October, the manufacturing index rose to a four-month high at 50.7—compared to 50.6 in September—with a slight acceleration from the private sector. Even the manufacturing output index rose to a 19-month high. It was 52.4 in October.

The iShares MSCI France (EWQ) rose 4.5% from a year ago as of October 23. About a 10.3% price increase was seen in the past month. Stocks like Sanofi (SNY), Alcatel-Lucent (ALU), Renault (RNLSY), Alstom (ALSMY), and Schneider Electric SE (SBGSY) rose 6.5%, 3.9% 25.3%, 3.9%, and 6.5%, respectively, over the past month.

Even energy stocks like CGG (CGG) and Total (TOT) rose 8.1% and 14.0%, respectively, for the same period. This was due to stabilizing crude oil prices.

Service sector rose to 52.3 in October

October data saw an overall growth in categories like manufacturing as well as the service industry. France’s service activity index rose to a four-month high. It was 52.3 in October compared to 51.9 in September. Companies like AXA (AXAHY) and BNP Paribas (BNPQY) rose 10.6% and 6.9% as of October 23.

Although there was a rise in new orders in manufacturing and services, employment fell for the second month in October. Low oil and steel prices kept the input cost lower for manufacturers while service providers saw the sharpest rise in input prices in October due to higher staff costs.

Business sentiment is improving. However, falling employment softens the labor market. The French economy needs to continue its growth momentum to rebound and achieve its growth target of 1% this year.

Along with France, Germany’s PMI data are also out. We’ll discuss Germany’s data in the next part.