Hormel’s Specialty Food Segment Performed Well in 3Q15

Hormel Foods Corporation, based in Austin, Minnesota, is a multinational manufacturer and marketer of consumer-branded food and meat products.

Dec. 4 2020, Updated 10:53 a.m. ET

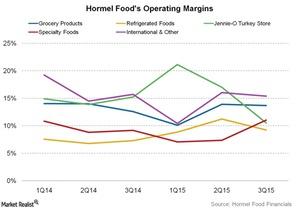

Hormel’s Specialty Food segment’s fiscal year operating highlights

- The Refrigerated Food segment’s operating profit rose 9%, including Applegate transaction costs of $8.6 million. Its volume rose 2% while its dollar sales fell 11%.

- The Jennie-O Turkey Store segment’s operating profit, volume, and dollar sales fell 45%, 16%, and 12%, respectively.

- The outbreak of the avian influenza virus earlier this year had a substantial impact on the downfall of the respective segments.

- The Grocery Product segment’s operating profit, volume, and dollar sales fell 57%, 10%, and 8%, respectively. This excludes incremental net sales of Mega Mex food products with flat volume and dollar sales.

- The Specialty Food segment’s operating profit, volume, and dollar sales fell 79%, 26%, and 31%, respectively. This excludes incremental sales of CytoSport Holding’s products. Its volume rose 1% while its dollar sales fell 7%.

- The International & Other segment’s operating profit rose 3% while its volume and dollar sales fell 4% and 6%, respectively.

Company overview

Hormel Foods Corporation, based in Austin, Minnesota, is a multinational manufacturer and marketer of consumer-branded food and meat products. The company leverages its extensive expertise, innovation, and high competencies in pork and turkey processing and marketing to bring branded, value-added products to the global marketplace.

The company enjoys a strong reputation among consumers, retail grocers, food service customers, and industrial customers. The company operates in five segments:

- Grocery Products

- Refrigerated Foods

- Jennie-O Turkey Store

- Specialty Foods

- International & Other

Hormel Foods’ (HRL) main competitors in the industry are Pilgrim’s Pride (PPC), Sanderson Farms (SAFM), and Tyson Foods (TSN), which have market caps of $5.25 billion, $1.52 billion, and $16.14 billion, respectively.

The Consumer Staples Select Sector SPDR Fund (XLP) invests 0.86% of its portfolio in TSN and the SPDR S&P 500 ETF Trust (SPY) invests 0.06% of its portfolio in TSN.