Goldcorp Forms Project Corridor Joint Venture with Teck Resources

The combined project will be a 50:50 joint venture between Goldcorp and Teck with the interim name of Project Corridor.

Sept. 10 2015, Updated 9:06 a.m. ET

Project Corridor

After taking over the 30% stake from New Gold (NGD), Goldcorp (GG) announced an agreement to combine its El Morro project with Teck Resources’ (TCK) Relincho project in Chile to form a single project. While El Morro is a copper-gold project, Relincho is primarily a copper-molybdenum project. Teck’s Relincho is located 40 kilometers away from El Morro. The combined project will be a 50:50 joint venture (or JV) between Goldcorp and Teck with the interim name of Project Corridor.

Chuck Jeannes, Goldcorp’s president and CEO, said “This transaction allows us to consolidate the ownership of El Morro and work with Teck to jointly develop the Relincho and El Morro deposits in a way that is expected to deliver significant synergies to our respective stakeholders and shareholders.”

Assessment studies

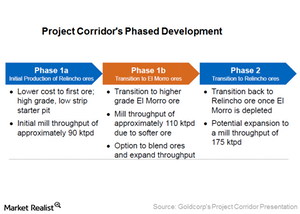

According to a preliminary economic assessment (or PEA), Project Corridor will have a conveyor to transport ore from the El Morro site to a single line mill at the Relincho site. A PEA is an early-stage feasibility study conducted to assess the economic, technical, and geographical viability of a project to determine if the mining project is ready to go forward. A pre-feasibility study (or PFS) is the next, more detailed, stage.

According to the company, a pre-feasibility study (or PFS) is expected to start in early 2016, to be completed by mid-2017. A feasibility study would be initiated afterwards if the results of the PFS are positive. To read more about the phases involved in the life cycle of a mine, visit Market Realist’s Everything you need to know about gold and gold companies.

Investors who don’t want to pick up individual companies can invest in gold miners through the VanEck Vectors Gold Miners ETF (GDX). This ETF invests in senior and intermediate gold miners. Goldcorp forms 7.6% of GDX’s holdings. The SPDR Gold Trust (GLD), on the other hand, provides exposure to spot gold prices.

In the next part of this series, we’ll discuss what benefits will accrue to Goldcorp and New Gold through the combination of their respective projects.