Goldcorp Acquires New Gold’s 30% Interest in the El Morro Project

On August 27, Goldcorp (GG) announced that it has entered into an agreement with New Gold (NGD) to acquire its 30% interest in the El Morro gold-copper project in Chile.

Sept. 9 2015, Updated 9:07 a.m. ET

Acquisition of 30% stake

On August 27, Goldcorp (GG) announced that it has entered into an agreement with New Gold (NGD) to acquire its 30% interest in the El Morro gold-copper project in Chile. On completion of the acquisition, Goldcorp will own 100% of this project.

Under the terms of the agreement, Goldcorp will pay $90 million in cash plus 4% gold stream of future production from El Morro to NGD.

According to Goldcorp, New Gold will make payments of $400 per ounce of gold delivered under the contract. This is subject to a 1% per annum adjustment once 217,000 ounces have been delivered.

About El Morro project

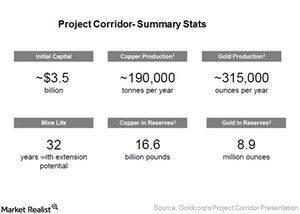

The El Morro project is located in Northern Chile. It covers an area of 417 square kilometers. A late 2011 feasibility study estimated the development costs of the project to be $3.9 billion. Copper and gold reserves are estimated at 16.6 billion pounds and 8.9 million ounces, respectively, with a production of approximately 190,000 tons per year of copper and 315,000 ounces of gold per year.

Combined, NGD and GG form 9% of the VanEck Vectors Gold Miners ETF (GDX). Investors can access the gold industry by investing in gold-backed ETFs such as the SPDR Gold Trust (GLD).

In the next part of this series, we’ll see how Goldcorp plans to combine its 100% stake in El Morro with Teck Resources’ (TCK) project in Chile to form a 50:50 joint venture.