Crude Oil Prices Are Trading in a Downward Trending Range

October WTI crude oil futures rose for the first time after falling for two consecutive days. Slowing US crude oil production is driving crude oil prices.

Sept. 16 2015, Published 8:01 a.m. ET

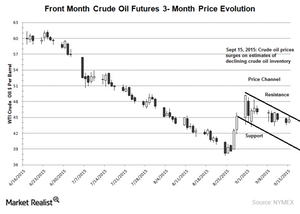

Price channel

October WTI (West Texas Intermediate) crude oil futures rose for the first time after falling for two consecutive days. Prices are fluctuating between a narrow channel of $44 per barrel and $46 per barrel in September 2015. The slowing US crude oil production and estimates of the falling crude oil inventory are driving crude oil prices.

Key pivots

The pessimistic sentiments of oversupply and weak demand cues could drag crude oil prices lower. Crude oil prices could see support at $38 per barrel. Prices hit this mark in August 2015. In contrast, the consensus of falling crude oil stocks, short covering, and bottom fishing could push crude oil prices higher. The next resistance for WTI is seen at $50 per barrel. Prices hit this mark in August 2015.

Citigroup estimates that US oil prices could hit $32 per barrel in the short term. Societe Generale estimates the crude oil prices could trade around $49.40 per barrel in 2016. Goldman Sachs estimates that crude oil prices could hit $20 per barrel in the worst case scenario. The downward trending price channel suggests that crude oil prices could average between $42 per barrel and $48 per barrel in the short term.

The recent rise in crude oil prices could benefit oil and natural gas producers like QEP Resources (QEP), EOG Resources (EOG), and Anadarko Petroleum (APC). These companies account for 7.31% of the Energy Select Sector SPDR ETF (XLE). These companies’ crude oil production mix is more than 32% of their production portfolio.

ETFs like the Velocity Shares 3X Long Crude ETN (UWTI) benefit from rising crude oil prices. In contrast, ETFs like the ProShares UltraShort Bloomberg Crude Oil ETF (SCO) benefit from falling crude oil prices.