China’s Falling Stock Market Pushes Gold Upward

The turnaround from the direction that gold was headed during the last month has also supported silver prices. Silver fell marginally by 0.68% last month.

Sept. 8 2015, Updated 2:21 p.m. ET

Gold rose significantly from the low in July

Gold rose on Friday, August 21 by 0.50% and touched the high of $1,167.90 per ounce. It’s almost a 7% rise from the five-year low of $1,073 per ounce that it touched in the July rout. The falling Asian markets, followed by the US markets, pushed investors away from the risky assets. It lured them into investing in a store of value assets. Gold’s safe-haven spirit seemed to be on a high.

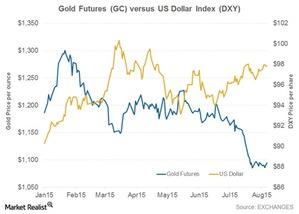

Also, the unsure Fed moves from the Thursday meeting caused a loss of returns on dollar investments. The weakening dollar acts as a support for gold prices. We can see the performance of gold along with dollar in the above chart.

Other precious metals and miners

The turnaround from the direction that gold was headed during the last month has also supported silver prices. Silver fell marginally by 0.68% during the last trading month. Other precious metal counterparts like platinum rose ~3% and palladium fell ~2.60%.

Mining companies had a mixed performance during the last week. Companies like New Gold (NGD) and Pan America Silver (PAAS) rose on a five-day trailing basis. In contrast, companies like AngloGold Ashanti (AU) and GoldCorp (GG) fell on a five-day trailing basis. Together, these companies contribute ~13% to the VanEck Vectors Gold Miners ETF (GDX).

Global risk

Falling Chinese stocks followed by the other Asian countries like Japan, India and Singapore, coupled with weak US data increased the pressures regarding global growth. The rising uncertainty on the rate hike expectations and a probable delay due to the unfavourable outcome of the data could result in more market volatility. This could be positive for gold. For the first time since 2009, the hedge funds are having a net-long position in gold, according to the weekly data from the CFTC (Commodity Futures Trading Commission).