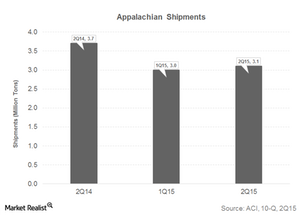

Arch Coal’s Appalachian Shipments Remain under Pressure in 2Q15

In 2Q15, Arch Coal’s (ACI) Appalachia segment shipped 3.1 million tons of coal, down from 3.7 million tons in 2Q14, but up from 1Q15’s 3.0 million.

Sept. 2 2015, Updated 2:06 p.m. ET

Arch Coal’s 2Q15 Appalachian shipments

In 2Q15, Arch Coal’s (ACI) Appalachia segment shipped 3.1 million tons of coal, down from 3.7 million tons in 2Q14, but up from 1Q15’s 3.0 million. Shipments in 1Q15 included 1.6 million tons of metallurgical coal (used in steelmaking) and 1.5 million tons of thermal coal (used in power generation). In 1H15, the segment shipped 6.1 million tons of coal, which included 3.1 million tons of met coal.

Domestic thermal coal shipments were marred by weak natural gas prices and the implementation of the Mercury and Air Toxics Standards (or MATS) in April 2015. International metallurgical coal shipments remained under pressure from slowing growth in China, global oversupply, and a strong US dollar.

Price per ton

Arch Coal’s selling price per ton at the Appalachia segment came in at $65.83 in 2Q15. This was lower than 2Q14’s $69.36. Met coal benchmark prices tumbled to $110 per ton in 2Q15 compared to $120 per ton in 2Q14. Met coal prices have fallen to $93 per ton in 3Q15. Note that American met coal is currently trading at a heavy discount to the benchmark. The benchmark is a grade of Australian met coal.

2Q15 pricing came in marginally higher than $65.23 in 2Q14 due to a higher share of high-value met coal in the product mix. The prices averaged $65.53 in 1H15 compared to $68.54 in 1H14.

About Arch Coal’s Appalachian segment

Arch Coal runs seven active mines in the Appalachian region, producing both metallurgical as well as thermal coal. These mines are connected by CSX Corporation (CSX) and Norfolk Southern (NSC) railways. Consol Energy (CNX) and Alpha Natural Resources are some of the other key coal producers (KOL) operating in the region.