Why Arch Coal Is in the News for Debt Exchange

On August 4, 2015, Arch Coal completed a reverse stock split to boost its stock price above the dollar mark and stay listed on the NYSE.

Sept. 1 2015, Published 1:48 p.m. ET

Arch Coal’s debt exchange

Back in October 2014, we predicted that Arch Coal (ACI) could be next in line, after Walter Energy and Alpha Natural Resources, to go bankrupt. Arch Coal (ACI) has employed various measures to stay afloat in the current difficult environment for the industry and proven us wrong.

On August 4, 2015, Arch Coal completed a reverse stock split to boost its stock price above the dollar mark and stay listed on the NYSE. The company also launched a debt exchange program on July 2 to deleverage its balance sheet and to improve its liquidity position. The debt exchange offer was extended a couple of times due to certain disagreements with some lenders. However, last week, the deadlock seemed to break when Bloomberg Businessweek reported that the company “is seeking a compromise with lenders opposing a debt-swap deal.”

Holders of some senior debt will have to let go of over half of the face value of ACI’s bond that they hold under the terms of the exchange program. This will reduce Arch Coal’s debt level and interest expenses. You can find details about the debt exchange program in the company’s filing.

About Arch Coal

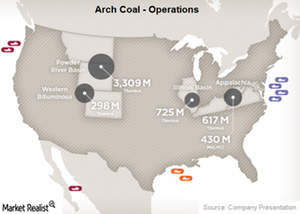

Arch Coal (ACI) is a diversified coal producer mining both metallurgical coal and thermal coal in the United States. Arch Coal has operations in each of the major US coal-producing regions, namely:

- Appalachia

- Illinois Basin

- Powder River Basin

- Western Bituminous Region

Consol Energy (CNX) mines coal in Appalachia while Peabody Energy (BTU) operates in the Illinois Basin, Powder River Basin, and Western Bituminous Region. Cloud Peak Energy (CLD) operates solely in the Powder River Basin. No other American coal producer (KOL), apart from Arch Coal (ACI), operates in all four regions.