Analyzing Lululemon Athletica’s Revenue Performance this Year

Lululemon Athletica (LULU) reported revenue of $423.5 million in 1Q16, up 10% year-over-year.

Sept. 9 2015, Updated 10:07 a.m. ET

Revenue growth drivers for Lululemon Athletica

Lululemon Athletica (LULU) reported revenue of $423.5 million in 1Q16, up 10% year-over-year. That number came in ahead of the company’s indicative guidance of $413 million–$418 million, which the company provided in its 4Q15 earnings call. Consensus analysts’ estimates had projected revenue of ~$419 million.

This was despite headwinds from a higher US dollar and the West Coast ports impasse, which reduced store inventory. LULU estimates that the higher US dollar reduced its top line by $15.2 million. LULU derives about ~30% of its revenue from outside the United States.

Store expansion

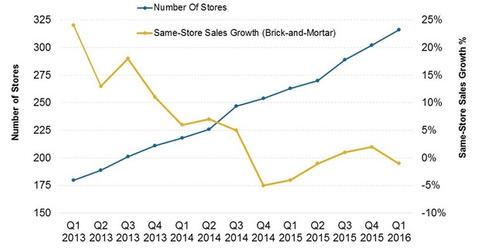

In 1Q16, LULU’s revenue growth was propelled by higher e-commerce sales and expansion in the company’s store footprints. A growth company, LULU continued to roll out stores both in North America and overseas. LULU added 53 new stores in 1Q16 compared to 1Q15. It added 13 new Ivivva stores. Its total square footage grew by 21.7% to 931,000.

The company added 14 new stores in 1Q16 compared to 4Q15. The total square footage grew by 37,000. These additions included seven Ivivva stores, six US stores, and one store in Canada.

Same-store sales

Total same-store sales, including e-commerce sales, came in at 2%. Reported same-store sales for brick-and-mortar stores came in at -5%. The higher US dollar reduced reported same-store sales by 4%.

Performance for LULU’s Ivivva and Men’s businesses was particularly strong. These businesses reported total comps of 29% and 19%, respectively. The company also reported improved traffic and conversion at stores in Canada, which had been challenged lately.

Revenue drivers

Lululemon’s design and product innovation functions are very robust. The company’s differential appeals to a more health and wellness–based and yoga-based lifestyle, which also ensures a loyal fan base. This lets the company effectively compete even when its prices are higher than most rivals.

Lululemon’s vertically integrated model also ensures higher margins. Peers Nike (NKE) and Under Armour (UA) are also expanding their store footprints rapidly to benefit from higher direct-to-consumer sales. However, most sales still take place through the wholesale channel for these firms. Nike is the largest supplier to sporting goods retailer Foot Locker (FL), for example.

The SPDR S&P 500 ETF (SPY) and the Vanguard S&P 500 ETF (VOO) each invest ~0.5% of their holdings in Nike and Under Armour.

The next article in this series discusses e-commerce, one of the fastest-growing businesses for LULU.