US Employment Report: Will It Keep the Hopes of a Rate Hike Going?

Since the current set of data were better than the market expectations, the market’s hopes for a September rate hike are still on.

Aug. 18 2015, Updated 9:07 a.m. ET

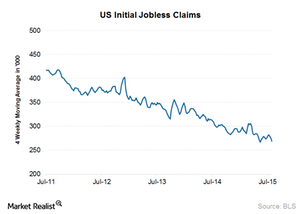

Initial jobless claims rise less than expected

Initial jobless claims are the number of US workers filing for jobless benefits for the first time. The claims rose by 3,000 to a seasonally adjusted 270,000 for the week ending August 1. The figure came in below economists’ expectations of 273,000. The four-week moving average was 268,250—a fall of 6,500 from the previous week.

Since the weekly data could have statistical noise, analysts usually prefer the four-week average of jobless claims. The number of jobless claims indicates that the labor market is firming. Usually, a number below 300,000 is associated with a firming labor market.

Implications for gold investors

The labor market strength is positive for the economy and the US dollar. The Fed is closely watching this information along with other factors that will help it decide the timing and quantum of the rate hike.

Since the current set of data were better than the market expectations, the market’s hopes for a September rate hike are still on. The timing of the Fed’s rate hike impacts gold-backed ETFs like the SPDR Gold Trust (GLD).

Other affected investments include Eldorado Gold (EGO), Gold Fields (GFI), Newmont Mining (NEM), and Yamana Gold (AUY). The timing of the rate hike also affects ETFs that invest in these stocks like the VanEck Vectors Gold Miners ETF (GDX). Together, Newmont Mining and Yamana Gold account for 10.10% of GDX’s holdings.

In the next part of this series, we’ll look at another important piece of information in the US labor market—the net job adds.