Peñasquito Helps Achieve Record Quarterly Production for Goldcorp

The Peñasquito mine contains gold, silver, lead, and zinc. It achieved its first commercial production in 2010, on schedule and on budget.

Aug. 11 2015, Updated 3:07 p.m. ET

Peñasquito mine

Mexico’s largest open-pit mine, the Peñasquito mine is located in the northeastern portion of the state of Zacatecas in north-central Mexico. It consists of two open pits—Penasco and Chile Colorado. The Peñasquito mine contains gold, silver, lead, and zinc. It achieved its first commercial production in 2010, on schedule and on budget.

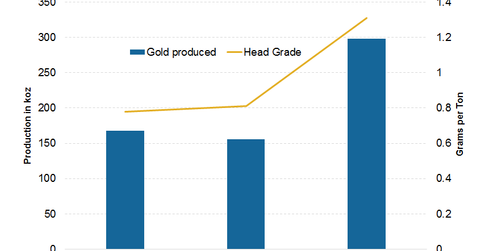

Record gold production

During 2Q15, Goldcorp’s (GG) Peñasquito mine achieved a record gold production of 298,000 ounces at an all-in sustaining costs (or AISC) of $416 per ounce. The production is higher than the mine’s previous record of 167,000 ounces. Peñasquito delivered strong production growth on the back of higher gold ore grades and higher metallurgical recoveries. Higher sulfide ore grades were due to the 18.5% positive model reconciliation from mining in Phase 5C in the heart of the deposit.

The AISC of $416 per ounce was 15% higher year-over-year, mainly due to the lower by-product credit sales, higher sustaining capital expenditures, and higher operating costs.

Higher grades to moderate

Goldcorp (GG) noted during the call that the particularly higher grades in the second quarter are expected to moderate later in the year. Peñasquito achieved grades of 1.31 grams per ton in gold in 2Q15. Management guided grades to average 0.8 grams per ton in the second half as the positive grade reconciliation ceases to exist. Goldcorp still maintained its production guidance toward the high end of 2015 guidance of 700,000–750,000 ounces.

Newmont Mining (NEM) has upgraded its 2015 production guidance for gold from 4.6 million–4.9 million ounces to 4.7 million–5.1 million ounces. This is mainly to reflect the inclusion of the Cripple Creek & Victor Gold Mine (or CC&V) and the building of Long Canyon Phase 1. Barrick Gold (ABX), on the other hand, has reduced its production guidance for 2015 to account for its divestitures to date.

Investors who don’t want to pick up individual companies can invest in gold miners through the VanEck Vectors Gold Miners ETF (GDX), which invests in senior and intermediate gold miners. Newmont forms 6.4% of GDX’s holdings. The SPDR Gold Shares ETF (GLD), on the other hand, provides exposure to spot gold prices.

Apart from Peñasquito, the ramping-up of the Cerro Negro and Eleonore mines also helped Goldcorp’s production in 2Q15. In the next article, we’ll see if these mines are ramping up to schedule to provide Goldcorp with much-needed production growth.