What Methods Are Used to Determine REITs’ Valuation?

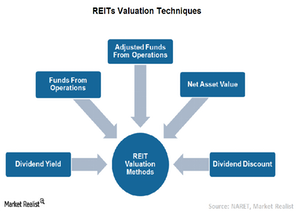

Traditional valuation methods don’t apply to REITs because their operations are different from traditional companies. REITs are valued based on three main techniques.

Sept. 4 2015, Updated 9:06 a.m. ET

Traditional valuation methods aren’t relevant

Traditional valuation methods don’t apply to REITs because their operations are different from traditional companies. REITs like Simon Property Group (SPG), Ventas (VTR), and Equity Residential (EQR) purchase properties based on estimated cash inflows from that property over its life term, not on earnings or historical book values. In this case, the assets are more important. REITs are valued based on three main techniques namely FFO (funds from operations), AFFO (adjusted funds from operations), and NAV (net asset value). We prefer to ignore the dividend discount method because it isn’t very appropriate for REITs’ valuation.

Fund From Operations

FFO is a measure used by REITs to evaluate the cash generated from their operations. The formula is:

FFO = net income + depreciation and amortization + impairment charges + losses from sale of property – gains from sale of property

Similar to EPS (earnings per share), FFO per share is used as a barometer to gauge a REIT’s profitability per unit of shareholder ownership. FFO per share is derived by dividing FFO by the weighted average of fully diluted shares.

AFFO

FFO doesn’t deduct the capital expenditures required to maintain the existing portfolio of properties that’s required to sustain properties’ economic income. In other words, FFO tends to overstate a REIT’s profitability. In order to correct this anomaly, some adjustments need to be made to FFO to arrive at a REIT’s cash flow.

AFFO = FFO – recurring capital expenditures +/- adjustments for straight-lining of rents.

Recurring capital expenditures in the above formula are those that are necessary to maintain properties and income streams like new carpet and drapes, appliances, leasing expenses, and tenant improvement allowances.

Straight-line rent is also known as “non-cash revenue.” A long-term lease often contains contractual rent increases over the life of the lease. In such cases, the company must “straight-line” the entire revenue stream over the term of the lease rather than recognize revenue because the cash is collected each period.

NAV

One of the most important valuation metrics for REITs is NAV. It tries to determine the underlying value of a REIT. NAV is the market value of all the assets, including cash and indirect property assets, net of liabilities and deliberated dividends or distributions. A high NAV indicates that REITS have strong earning potential and good management.

Investors looking for diversification in the REIT sector can get exposure to REIT ETFs like the Vanguard REIT ETF (VNQ), the iShares U.S. Real Estate ETF (IYR), and the iShares Cohen & Steers REIT ETF (ICF).