Investors Are Excited about Barrick Gold’s 2Q15 Results, but Why?

In this series, we’ll analyze Barrick Gold’s 2Q15 results. Barrick stock reacted positively to its earnings report, its improved cost guidance, and its progress toward reducing its debt.

Aug. 19 2015, Updated 10:31 a.m. ET

2Q15 results in line with expectations

Barrick Gold (ABX) announced its 2Q15 results on August 5 and conducted an earnings call on August 6. The mining firm reported adjusted EPS (earnings per share) of $0.05, in line with consensus expectations. The company’s revenues fell 9.2% year-over-year to $2.2 billion. This is mainly due to the fall in gold prices and to lower sales volume. The market was expecting this decline.

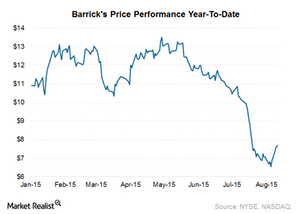

Barrick’s share price reacted positively to its results, its improved cost guidance, and its progress toward reducing its debt. The stock rose 7.5% within two days of the results announcement.

The market was probably especially excited about the company’s deleveraging plan. As we’ll discuss later in this series, Barrick has also improved its cost guidance, which is another reason for investors to hope for the best.

Series overview

In this series, we’ll analyze Barrick Gold’s 2Q15 earnings report. We’ll look at the firm’s production and cost performance and the reasons for its improved cost guidance. We’ll also discuss recent developments with its asset sales and the company’s progress toward its debt reduction target.

About Barrick

Barrick Gold Corporation is the world’s largest gold producer. It produces and sells gold as well as significant amounts of copper. Barrick has the largest quantity of gold reserves, totaling 93 million ounces as of December 2014. It also has 9.6 billion pounds of copper reserves.

Newmont Mining (NEM) has the second-highest reserve base with 82.2 million ounces. It’s followed by Goldcorp (GG) with 49.6 million ounces. Yamana Gold (AUY) and Agnico Eagle Mines (AEM) reserves are comparatively small at under 20 million ounces each.

Investors can access the gold industry through gold-backed ETFs such as the SPDR Gold Trust (GLD) and GDX. ABX, NEM, and GG make up 20.2% of GDX’s holdings.