Vale’s 2Q15 Profitability Gets Boost from Iron Ore Cost Control

Vale’s (VALE) iron ore production for 1H15 was a record 159.8 million tons, 9.3 million tons higher than 1H14. For 2Q15, production was the second highest on record at 85.3 million tons.

Aug. 11 2015, Updated 3:07 p.m. ET

Record 2Q15 iron ore production

Vale S.A.’s (VALE) iron ore production, excluding iron ore acquired from third parties and Samarco’s production, was the second highest on record at 85.3 million tons for 2Q15. For 1H15, production was a record 159.8 million tons, which is 9.3 million tons higher than 1H14.

Vale produced 9.8 million tons from the N4WS mine with very high 65.1% iron ore content. The company expects to produce still higher content iron ore from this mine in the second half of the year.

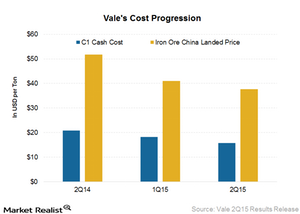

Lower costs boost profitability

EBITDA (earnings before interest, taxes, depreciation, and amortization) for iron ore fines in 2Q15 was $1.2 billion, which is 104% higher quarter-over-quarter. This is mainly because of higher realized iron ore prices, higher sales volumes, and lower costs.

Total C1 (cash cost) at the port for iron ore, which includes mine, plant, railroad, and port, was $1 billion after royalties. Cash costs are calculated after deducting iron ore freight costs of $703 million, depreciation of $263 million, iron ore acquired from third parties at $68 million, and one-off effects of $86 million from costs of goods sold (or COGS).

C1 FOB (free on board) per metric ton in 2Q15 was $15.80, which is 14% quarter-over-quarter. The reduction in costs is driven by depreciation of the Brazilian real. Overall, Vale’s ferrous minerals performance beat market expectations due to lower costs and higher realized prices.

Price outlook under pressure

Vale’s Carajás Serra Sul S11D project, which will add another 90 million tons to its production, is going on as planned. This production growth from large companies, including BHP Billiton (BHP), Rio Tinto (RIO), and Vale (VALE), without a proportionate increase in demand, is putting downward pressure on prices. This could negatively affect pure-play, high-debt iron ore names such as Cliffs Natural Resources (CLF).

It’s important to note that ETFs such as the iShares MSCI Global Metals & Mining Producers ETF (PICK) also provide exposure to the metals and mining sector. BHP and RIO form 28.9% of the fund’s total assets. The SPDR S&P Metals and Mining ETF (XME) also invests in metals and mining companies.

In the next part of this series, we’ll look at the factors that impacted Vale’s realized iron ore prices in the second quarter of 2015.