Why Are Capitalization Rates Important for Investors?

The capitalization rate, or cap rate, is an important concept in the commercial real estate industry. It’s defined as an initial yield on a real estate investment.

Sept. 4 2015, Updated 11:06 a.m. ET

What’s the capitalization rate?

The capitalization rate, or cap rate, is an important concept in the commercial real estate industry. The “capitalization rate” is defined as an initial yield on a real estate investment. It’s calculated as the annual NOI (net operating income) from the property divided by the acquisition cost of that property or its current market value. Net operating income is computed by deducting the operating expenses from the gross operating income. The operating expenses can be property taxes, maintenance costs, and salary, among others. NOI is used to measure the operating performance of the company’s properties while FFO (funds from operations) is used to measure the operating performance of a REIT.

A brief calculation would further simplify the concept. For example, a 10% cap rate means that the buyer of a property will receive $10 of the income per year from an investment of $100 in property acquisition. The cap rate is also a measure of how soon you can recover your investment in a property. In our example, the asset will be fully capitalized in ten years.

Why is it important?

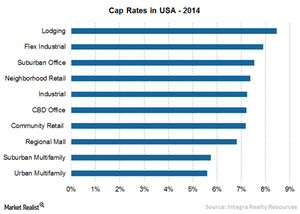

The rise in cap rates indicates that there’s a rise in income from the property relative to its price. This also gives an opportunity for investment as market value is low for the asset. In contrast, a fall in the cap rate indicates lower income from the property compared to its price. Vacancy rates are related to retail and industrial cap rates. Estimating and applying the appropriate cap rate is particularly important in valuing REITs like Simon Property Group (SPG), Equity Residential (EQR), and Ventas (VTR) by NAV (net asset value).

Investors looking for diversification in the REIT sector can get exposure to REIT ETFs like the Vanguard REIT ETF (VNQ), the iShares U.S. Real Estate ETF (IYR), and the iShares Cohen & Steers REIT ETF (ICF).