Procter & Gamble Supply Chain Initiatives Improve Productivity

In an effort to partially digitize its supply chain, P&G has introduced an automated re-ordering system. It maintains a count of inventory in stores and relays the information to its suppliers.

July 16 2015, Updated 9:05 a.m. ET

Improving inventory turnover

The Procter & Gamble Company’s, or P&G’s (PG), supply chain network includes more than 130 manufacturing sites and more than 200 distribution centers. P&G’s supply chain, distribution, and inventory figures have been improving since CEO A.G. Lafley’s return.

Supply chain initiative

In an effort to partially digitize its supply chain, P&G has introduced an automated re-ordering system. It maintains a count of inventory in stores and relays the information to its suppliers. P&G factory computers are linked via a satellite communication system. This helps speed up the delivery of products to Walmart’s (WMT) distribution centers or to other stores.

Sales to Walmart and its affiliate stores account for ~14% of P&G’s total revenue.

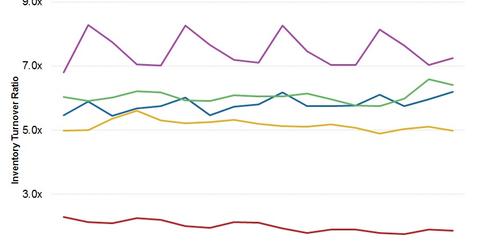

P&G’s inventory turnover metric improved to 6.1x in 3Q15[1. Quarter ending March 31, 2015] from 5.7x in 3Q14. Meanwhile, Colgate-Palmolive (CL) and Kimberly-Clark (KMB) have seen inventory turnover ratios fall as a result of negative currency effects. Estee Lauder’s (EL) inventory count remains in a range similar to what it was last year. Clorox’s (CLX) inventory turnover ratio is 7.2x, the highest of its peers, indicating higher sales in 3Q15. Innovations such as Clorox’s disinfecting wipes and toilet cleaners resulted in higher shipments.

Other changes in the supply chain network

Sales distribution has been better organized since CEO A.G. Lafley’s return. Here’s why:

- sales distribution of products is better organized across similar geographies

- network duplication has been cut, saving money

- overlapping roles within global business units and ground operations responsible for local sales and distribution have been eliminated

- e-commerce initiatives such as pgshop.com for direct-to-consumer sales have been introduced

P&G makes up ~2.9%[2. Updated as of June 27, 2015] of the SPDR Dow Jones Industrial Average ETF Trust (DIA).

Ongoing initiatives

P&G puts a premium on responsiveness. Its distribution goal is to deliver products with just one day of transit to 80% of retailers. To achieve this, P&G is building six mega-distribution centers in strategic locations across North America. These facilities are designed to receive and cross-dock products from all of P&G’s business units, making for speedy and efficient delivery of mixed truckloads. For more information on cross-docking, read Analyzing Walmart – The World’s Largest Retailer.

Also, P&G is adopting a demand-driven replacement model based on point of sale, or POS, information from its retail customers. To speed up response time, P&G suppliers are creating “supplier villages” next to its plants. This will allow an uninterrupted thread of POS data to the supplier base and on through the distribution network.