Newmont Mining Acquires Cripple Creek from AngloGold

The Cripple Creek & Victor mine is located near Colorado Springs, Colorado. It’s and open-pit mine that has been operational since 1995.

July 3 2015, Published 4:56 p.m. ET

Newmont acquires Cripple Creek

Newmont Mining (NEM) announced on June 8 that it has a purchase agreement to acquire the CC&V (Cripple Creek & Victor) gold mine from AngloGold Ashanti (AU). The transaction is expected to close in Q315.

The purchase consideration is $820 million in cash, plus a 2.5% smelter royalty for gold production from future underground ore. The acquisition will be financed through proceeds from equity issuance (83%) and cash (17%) from Newmont’s balance sheet.

Newmont will issue 29 million shares to acquire CC&V. These shares represent close to 7% of the company’s current market capitalization. The management believes that its current operating performance supports this financing approach. Management says that the issuing of shares is earnings and cash flow accretive to shareholders.

About CC&V

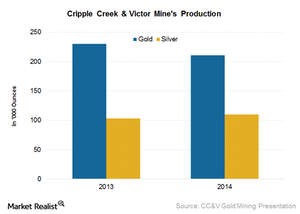

The CC&V mine is located near Colorado Springs, Colorado. It’s an open-pit mine that has been operational since 1995. It produced 211,000 ounces of gold and 110,000 ounces of silver in 2014. It offers a long mine life in a safe jurisdiction with low geopolitical risk.

Resource nationalism has become an issue in many African and South American countries. This, along with issues like difficult terrain and lack of infrastructure, has led to many stalled projects, including Barrick Gold’s (ABX) Pascua-Lama. That’s why companies are now looking to acquire projects in geographically and politically safe jurisdictions.

A huge concentration of Kinross Gold’s (KGC) production lies in Russia, which is one reason the market is discounting its share price relative to that of other gold miners.

Newmont forms 6% of the VanEck Vectors Gold Miners ETF (GDX), an ETF that invests in gold miners. The SPDR Gold Trust (GLD) provides exposure to spot gold.

In the next part of this series, we’ll discuss why the acquisition of the CC&V makes sense for Newmont.