What’s the Natural Gas Price Forecast?

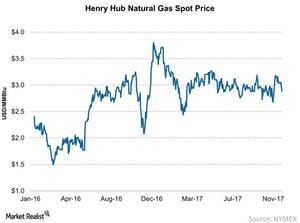

Henry Hub (MOO) natural gas prices saw a negative week-over-week trend, a continuation of the trend from the previous week.

Dec. 5 2017, Updated 10:33 a.m. ET

Natural gas

Henry Hub (MOO) natural gas prices saw a negative week-over-week trend, a continuation of the trend from the previous week.

Weekly movements

Last week, the average weekly natural gas prices at Henry Hub fell 1.6% week-over-week to $3.05 per MMBtu (million British thermal units) from a weekly average of $3.10 per MMBtu. However, compared to the weekly prices in the corresponding quarter a year ago, last week’s prices rose ~11% year-over-year.

Price outlook

The EIA (U.S. Energy Information Administration) will release its short-term energy outlook report on December 12, which will outline the expectations for natural gas prices in the short term.

In the recent report published on November 7, 2017, the EIA predicted that the natural gas prices would average $3.01 per MMBtu in 2017. In 2018, the natural gas prices are expected to go even higher to $3.10 per MMBtu.

Natural gas production has significantly increased in the US, which has kept the prices low. Low prices have been an incentive for nitrogen producers such as CF Industries (CF), PotashCorp (POT), Agrium (AGU), and Terra Nitrogen (TNH) to add capacity when the nitrogen fertilizer prices were higher. However, the low energy prices also pushed down the prices of nitrogen fertilizers, which has created excess capacity in the market.

This trend also affected Chinese players, which primarily use coal as an energy source. As a result, several marginal producers in China curtailed their production this year, which has somewhat balanced the supply-stabilized prices as we can see in the above chart.

Read on to know about phosphate fertilizer prices last week.