Why the Natural Gas-NGL Price Spread Impacts Energy MLPs

Natural gas processing MLPs typically benefit when the price of NGLs is high relative to natural gas.

July 15 2015, Updated 5:05 p.m. ET

NGL basics

NGLs (natural gas liquids) are liquid elements generally extracted from natural gas wells. They’re hydrocarbons, just like natural gas molecules. While natural gas is primarily methane, NGLs primarily consist of ethane, propane, butane, isobutane, and natural gasoline. In a given NGL barrel, ethane accounts for the largest share of all the elements. It’s primarily used in the production of ethylene, which is used in plastics production. Natural gasoline is composed mainly of pentanes and heavier hydrocarbons.

HGLs (hydrocarbon gas liquids) include NGLs and alkenes: ethylene, propylene, butylene, and isobutylene.

Spread impacts energy MLPs

Natural gas processing MLPs typically benefit when the price of NGLs is high relative to natural gas. This is because of the “keep-whole” and “percent-of-proceeds” contracts that these companies enter into.

Keep-whole contracts are commodity-price sensitive. Under keep-whole contracts, the processing company generally keeps a portion of the NGLs extracted through fractionation as payment. Fractionation involves separating mixed NGLs into various component elements. The company replaces the energy content of NGLs that it has retained with natural gas. A “frac spread” is the difference between the amount earned from NGL sales and the cost of natural gas. A decline in NGL prices makes the spread less favorable for fractionating MLPs.

In percent-of-proceeds contracts, the MLP gathers and processes natural gas on behalf of producer customers. The residue gas and NGLs produced from the processing are sold on the market. The company then remits a pre-agreed percentage of these proceeds to the producer and retains the remainder.

A decline in NGL prices may result in less demand for fractionation and processing services, which impacts MLPs providing such services.

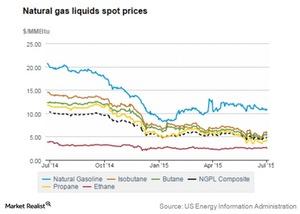

The above graph shows the fall in NGL spot prices over a year. NGL prices impact MLPs such as Targa Resources (NGLS), MarkWest Energy (MWE), DCP Midstream Partners (DPM), and Energy Transfer Partners (ETP). ETP forms ~7.6% of the Alerian MLP ETF (AMLP).