Key for Investors: Understanding Inflation and Its Implications

Inflation represents a rise in the general price level in a country or region. The higher the inflation, the lower the quantum of a particular good that can be purchased.

Nov. 20 2020, Updated 4:04 p.m. ET

Inflation in a nutshell

Inflation represents a rise in the general price level in a country or region. The higher the inflation, the lower the quantum of a particular good that can be purchased compared to the past. In the investment world, you might have heard of “inflation-adjusted” or “real” returns. This adjustment is done to understand whether your investment is providing returns above the prevailing level of inflation.

Different for developed and emerging economies

Like economic growth, inflation is comparable for countries in the same stage of evolution in the business cycle. Emerging economies have a higher rate of consumption growth and spending growth. As a result, a high level of inflation is normal for these economies.

In contrast, nations with mature economies already have developed infrastructure and facilities. They don’t need large investments in those cost-intensive areas. As a result, they generally don’t experience a high level of inflation. Also, higher inflation for developed countries has implications like reduced international competitiveness of goods produced. Their costs of production will be pushed higher.

Why it’s important

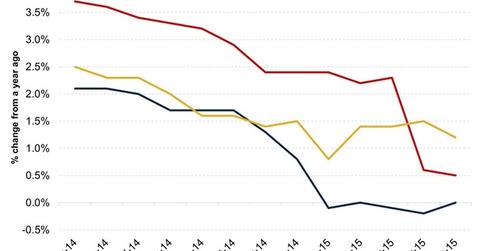

Several central banks are directly or indirectly responsible for controlling inflation through monetary policy. Currently, the low level of inflation has been a big hindrance for the US Federal Reserve. It has hindered lifting the federal funds rate off the near zero levels that it was reduced to in December 2008.

This issue has been mentioned in all of the Federal Reserve’s meeting minutes. It was also included in Fed Chair Janet Yellen’s testimony to Congress.

A change in the federal funds rate is expected to impact Treasury yields at the short end of the curve. It will also impact ETFs like the iShares 1-3 Year Treasury Bond Fund (SHY). In contrast, a rise in inflation expectations negatively impacts longer-dated bonds and ETFs like the iShares 20+ Year Treasury Bond ETF (TLT).

Since inflation expectations impact the long end of the Treasury yield curve, it can impact long-duration loan rates like housing loans. It can also impact companies like Annaly Capital Management (NLY) and homebuilders like Toll Brothers (TOL) and PulteGroup (PHM). A rise in loan rates can reduce the demand for homes.

After inflation, let’s look at the importance of industrial production.