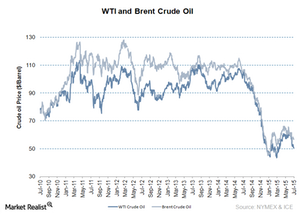

Brent and WTI Crude Oil Prices Widen in the Depressed Oil Market

August WTI crude oil futures contracts fell by $0.74 and closed at $50.15 per barrel on July 20. Brent fell by $0.45 and settled at $56.65 at the close of trade.

July 22 2015, Updated 9:07 a.m. ET

WTI and Brent crude oil

August WTI (West Texas Intermediate) crude oil futures contracts fell by $0.74 and closed at $50.15 per barrel on Monday, July 20, 2015. Similarly, Brent fell by $0.45 and settled at $56.65 at the close of trade yesterday. The US WTI and Brent differential rose by $6.65 per barrel as of July 20, 2015. This is the widest spread between WTI and Brent since April 24, 2015.

Record production from the US and the appreciating US dollar continue to drag US WTI crude oil prices lower. Likewise, speculation of rising supplies from Iran and the Middle East continue to drag Brent crude oil lower. The oversupplied oil market and the consensus of slowing demand will continue to put downward pressure on crude oil prices.

The rising spreads benefit US crude oil refining companies like Marathon Petroleum (MPC), Tesoro (TSO), and Valero Energy (VLO). Combined, these companies account for 7.12% of ETFs like the Select Sector SPDR Fund ETF (XLE). In contrast, a narrow spread benefits US crude oil producers. The roller coaster ride of crude oil prices also impacts energy ETFs like the Select Sector SPDR Fund ETF (XLE) and the SPDR S&P Oil & Gas Exploration & Production ETF (XOP).

Oil benchmarks

Brent crude oil is the global benchmark for crude oil. Brent crude oil represents the receiving price of international crude oil producers. In contrast, WTI is the US benchmark for crude oil. WTI is priced at Cushing, Oklahoma—the futures contract delivery point for NYMEX crude oil. WTI is the receiving price of oil producers in the US. The rising spread between the US benchmark and Brent means that US refiners pay less to buy crude oil—compared to the international refiners. This benefits US refiners. The falling spread means that US producers sell crude oil prices equivalent to international oil producers. This benefits US oil producers.