Aluminum Contango Widens as Market Expects Prices to Recover

A wider contango is generally associated with a short-term oversupply in the market. Aluminum market dynamics took a beating as China’s aluminum exports are reaching alarming levels.

July 30 2015, Updated 4:36 p.m. ET

Aluminum contango widens

Previously, we saw that spot aluminum prices are finding it tough to hold ground, plummeting to six-year lows. Spot prices are hovering around the crucial level of $1,600 per metric ton. Meanwhile, from an investor’s perspective, it’s pertinent to study the trend in aluminum forward prices as well. In this part, we’ll explore how the aluminum forward prices are playing out.

When forward prices are lower compared with spot markets, it’s called “backwardation.” On the other hand, when future prices are higher than current spot prices, it’s referred to as “contango.”

Contango

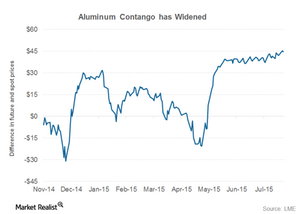

The above chart shows the difference between three-month aluminum forward and spot aluminum prices. At the start of the year, the three-month aluminum forward contract was trading at $27 per ton, or 1.5% higher over the corresponding spot prices.

On July 22, the spread was $45 per ton. The difference between current and three-month forward aluminum prices is ~2.8%, which is the highest in almost a year.

A wider contango could spur aluminum’s financial demand. This might boost aluminum prices in the short term.

Could aluminum prices recover?

A wider contango is generally associated with a short-term oversupply in the market. Aluminum market dynamics took a beating as China’s aluminum exports are reaching alarming levels.

Higher aluminum exports from China have put pressure on regional aluminum premiums as well. Lower aluminum premiums negatively impact primary producers such as Alcoa (AA), Vale (VALE), and Rio Tinto (RIO). Alcoa currently forms 2.26% of the Materials Select Sector SPDR ETF (XLB) and 0.83% of the iShares North American Natural Resources ETF (IGE).

We’ll explore the recent trend in aluminum premiums in the next part of this series.