Alcoa at a 52-Week Low: What Should Investors Do?

Alcoa was trading at its 52-week low on July 23 and closed at $9.96—breaching the psychologically crucial level of $10 per share for two consecutive days.

July 30 2015, Updated 4:34 p.m. ET

Alcoa hits its 52-week low

Alcoa (AA) was trading at its 52-week low on July 23 and closed at $9.96—breaching the psychologically crucial level of $10 per share for two consecutive days. The stock has traded weakly over the last few trading sessions, reaching new lows almost every day.

Dismal Wall Street performance

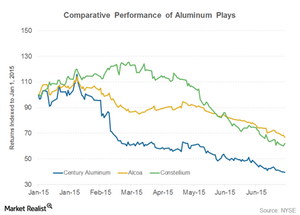

The rout is not limited to Alcoa alone, as other metal shares have also seen their share prices dwindle. The above chart shows the recent stock market performance of aluminum companies. Alcoa has lost more than one-third of its value since the beginning of the year while Century Aluminum (CENX) is down more than 60%. Together, Century Aluminum and Reliance Steel & Aluminum (RS) form ~8.9% of the SPDR S&P Metals and Mining ETF (XME).

Metal shares, including Alcoa and BHP Billiton (BHP), seem to defy all laws of gravity and lift. At a time when the broader US markets (SPY) are trading near their all-time highs, metal shares seem to be headed southward.

Series overview

In our previous series, we had noted that in the short term, market factors like aluminum prices and physical premiums would drive Alcoa. Its transformation strategy is a good long-term story, but it might not help the company escape what can be best described as a global metals meltdown.

In this series, we’ll look at some of the key indicators that Alcoa investors should track. This should help you understand where Alcoa could be headed in the coming months. We’ll also discuss some recent organizational changes at Alcoa.

Next, let’s begin by looking at the recent movement in aluminum prices.