Why Store Expansion is a Critical Driver for Lululemon Athletica

Despite having negative comps in 1H15, Lululemon’s revenue growth for its physical stores was positive at 9.7% year-over-year in fiscal 2015.

June 11 2015, Updated 12:05 p.m. ET

Brick-and-mortar drives sales for Lululemon

Lululemon Athletica (LULU) achieved revenue growth of 12.9% in fiscal 2015, with sales coming in at $1.8 billion for the year. Corporate-owned stores are the largest selling channel for LULU, accounting for 75% of its revenues, including sales from retail outlets owned by the company.

The channel’s revenue has risen at a CAGR (compound annual growth rate) of almost 28% over the last five years, to come in at $1.3 billion in fiscal 2015.

Store footprint

Despite being based in Vancouver, Canada, the majority of Lululemon’s stores are in the US. The company also plans to expand its retail footprint more in the US, compared with Canada. This trend is generally due to the US’s larger market size and its growing economy. Athleisurewear is the fastest growing apparel category in the US.

Store comps

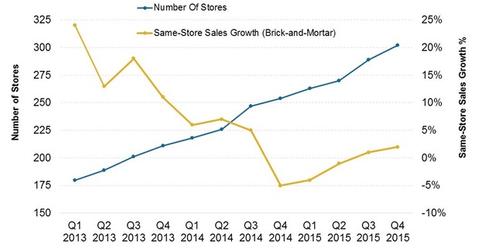

Despite having negative comps in 1H15, Lululemon’s revenue growth for its physical stores was positive at 9.7% year-over-year in fiscal 2015. Brick-and-mortar expansion spurred this growth. The company’s store count numbered 302 at the end of fiscal 2015. During the year, LULU had 48 store openings, including 13 in Q415. Of these 48 stores, 40 stores opened in the US, three in Canada, two in the United Kingdom, and one each in Australia, New Zealand, and Singapore.

In comparison, its competitor brand The Gap (GPS) had 101 Athleta stores in North America at the end of January 2015. Another competitor of Lululemon, L Brands’ (LB) PINK line had 125 stores in North America. Both LB and GPS constitute ~0.2% of the portfolio holdings of the SPDR S&P 500 ETF (SPY) and the iShares Core S&P 500 ETF (IVV).

Expansion plans

Lululemon (LULU) is planning on opening 60 new stores in fiscal 2016, including up to eight each in Europe and Asia and 20 Ivivva stores. Most of the new stores would open in the US. Lululemon projects that its North America store count will stand at 350 over the long term, compared with 268 stores at the end of fiscal 2015.

Lululemon also plans to have ~20 stores each in Asia and Europe by 2017. You can read more about LULU’s international expansion plans and their drivers in Part 7.