The Starbucks Market Mystique

Starbucks stock began its ascent in late September 2014. Prices increased even more after the first-quarter 2015 earnings were released on January 22, 2015.

Aug. 18 2020, Updated 6:34 a.m. ET

The rise of Starbucks

Starbucks (SBUX) has returned almost 28% to investors year-to-date, which is much more than the 7.6% that the Consumer Discretionary Select Sector SPDR Fund (XLY) has returned.

In this series, we’ll look at how the markets have reacted to the coffee retailer’s earnings. Often, this angle of inquiry gives us an idea about strategic changes or any other developments that may have contributed to the stock appreciation.

Starbucks shares on fire

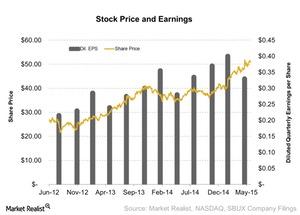

In the chart above, we have plotted the company’s diluted EPS (earnings per share), along with its share price movement over the last 12 quarters. If you look closely, share price began its ascent in late September 2014. Stocks increased even more after the first-quarter 2015 earnings were released on January 22, 2015.

Then, the share price rose by ~19%, from $41.09 to $49.27, before the second-quarter earnings were announced on April 23, 2015. Following each earnings release, analysts upwardly revised their forward EPS estimates.

On the financial performance front, in 1Q15, the company reported revenue growth of 13.3% to $4.8 billion. On an adjusted basis—excluding the revenue from its acquisition of 1,000 Starbucks units from its joint venture with Sazaby League in Japan—revenue grew by only 9%. EBITDA (earnings before interest, taxes, depreciation, and amortization) came in at $1.1 billion, which was a 2.8% surprise relative to analysts’ consensus estimate.

The Consumer Discretionary Select Sector SPDR Fund (XLY) benefited from the price rises in Starbucks stock. XLY invests 3% of its holdings in Starbucks, 4% in McDonald’s (MCD), and 1.5% in Yum! Brands (YUM).

In the next part of this series, we’ll learn about the announcement that set the stock on fire, leaving Dunkin’ Brands (DNKN) and Krispy Kreme (KKD) well behind.