Investment-Grade Corporate Bonds’ Issuance Fell Last Week

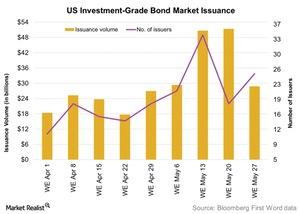

Investment-grade corporate bonds worth $28.8 billion were issued in the primary market in the week to May 27, 2016.

Nov. 20 2020, Updated 4:51 p.m. ET

Deals and volumes of investment-grade corporate bonds

Investment-grade corporate bonds worth $28.8 billion were issued in the primary market in the week to May 27, 2016. High-grade issuance stood at $51.4 billion in the previous week. However, the number of issuers rose to 25 from 18 in the previous week.

Yields on investment-grade corporate bonds fell marginally last week. As a result, the MFS Total Return Bond Fund – Class A (MRBFX) was flat and the Strategic Advisers Core Income Fund (FPCIX) rose 0.2% for the week ending May 27. The Vanguard Intermediate-Term Corporate Bond Fund (VCIT) rose 0.2% for the same period.

Major issuers

Walgreens Boots Alliance (WBA), Wells Fargo Bank (WFC), Lam Research (LMRX), and The Coca-Cola Company (KO) were among the large issuers of investment-grade bonds in the week to May 27.

Issuance by quality and maturity

Fixed-rate issues formed 92.3% of the total issuance while floating-rate issues worth $2.2 billion were issued last week.

Looking at the credit ratings of issues, BBB rated issuers were the most prolific. They made up 52.0%, or $15.0 billion, of the total issuance. They were followed by AA rated issuers. They formed 29.9% of the week’s issuance. Meanwhile, A rated papers formed 18.0% of the total issuance.

In terms of maturity, the largest chunk of issuance, making up 34.2% of all the issues, was in the five-year maturity category. It was followed by the ten-year maturity category. It commanded 23.3% of the total issuance. The three-year maturity category made up 17.7% of the total issuance last week.

The long-term maturity category such as the 30-year made up 3.4% of the total issuance. Meanwhile, the greater than 30-year and perpetual categories saw issuance last week after seven consecutive weeks of no issuance. They made up 0.9% and 7.1%, respectively, of the total issuance last week.

In the next part of the series, we’ll highlight the major deals including pricing, credit rating, and yields.