Vanguard Intermediate-Term Corp Bd ETF

Latest Vanguard Intermediate-Term Corp Bd ETF News and Updates

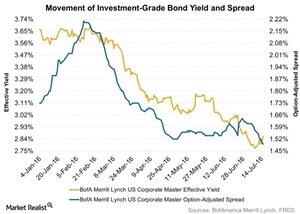

High-Grade Bond Yields Rose as Spreads Touched Their Lowest Level

Last week, high-grade bond yields rose after upbeat US inflation and retail sales data raised the possibility of a rate hike by the year’s end.

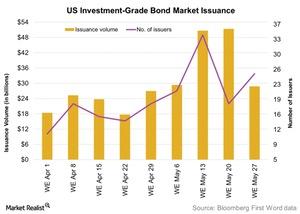

Investment-Grade Corporate Bonds’ Issuance Fell Last Week

Investment-grade corporate bonds worth $28.8 billion were issued in the primary market in the week to May 27, 2016.Financials Issuers like Wells Fargo and Verizon take advantage of low yields

Major deals included debt issues by Wells Fargo (WFC), Baidu, AT&T, and Verizon (VZ).

Why Richard Bernstein Sees Risk in ‘Safe’ Investments

Richard Bernstein believes that investors’ flocking to fixed-income products and shunning equities has increased their risk.