FedEx’s New Pricing Policy Improves Its Efficiency

Effective January 2015, FedEx changed its pricing policy for all of its FedEx Ground packages less than 3 cubic feet to a “dimensional weight pricing” mechanism.

Nov. 20 2020, Updated 2:35 p.m. ET

New pricing mechanism

Effective January 2015, FedEx (FDX) changed its pricing policy for all of its FedEx Ground packages less than 3 cubic feet, from the usual absolute weight-based pricing to a “dimensional weight pricing” mechanism. The new technique would compare the dimensional weight to the actual weight and bill the greater of the two.

What’s dimensional weight pricing?

The dimensional weight of an object is its cubic volume—the length x width x height of the box. The dimensional weight pricing mechanism calculates the weight of a package by multiplying the length, breadth, and height of the package, and then dividing by the dimensional factor. The dimensional factor for domestic shipments is 166 and for international packages it’s 139.

What are its implications?

The prime motive of making this change in the pricing mechanism was to generate higher revenue from lightweight packages that occupy large space in the trucks. Earlier, these products were only charged on the basis of their weights. The revenue that they generated would be lower than the space they occupied. Even though the pricing by this mechanism would be higher, it would guarantee better and effective service. It prices products better and brings more transparency to pricing. It removes the need for pricing adjustments in later stages. This reduces delivery delays.

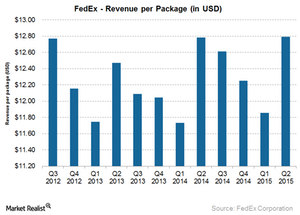

Applying this mechanism has already caused the revenue per package to grow by 3% for FedEx Ground in the third fiscal quarter. This is expected to help the company generate better revenues, improve margins, and cover operating costs more efficiently.

In the US, FedEx competes mainly with United Parcel Service (UPS). Smaller rivals include Air T (AIRT) and Air Transport (ATSG). FedEx forms the largest holding of 13.14% in the iShares Transportation Average ETF (IYT). IYT also holds 4.19% in Expeditors International (EXPD).