Consumer Sentiment Shines on Wall Street: Upbeat in June

In the US, consumer sentiment rose in June. The Consumer Discretionary Select Sector SPDR ETF (XLY) has gained about 1.22% over the past month.

June 29 2015, Published 9:31 a.m. ET

Consumer stocks shine on Wall Street

In the US, consumer sentiment rose in June. The Consumer Discretionary Select Sector SPDR ETF (XLY) has gained about 1.22% over the past month. It has gained a good 7.97% on a YTD (year-to-date) basis. In contrast, the broad market tracking SPDR S&P 500 ETF (SPY) is down 1.32% in the past month. So far, it returned 2.12% this year. Broad market performance in the US has been affected by the ongoing Greek crisis, as fears of a Grexit—Greece exiting the Eurozone—threaten to shake world markets.

Consumer sector companies like Nike (NKE), Bed Bath & Beyond (BBBY), and Darden Restaurants (DRI) were among the top gainers at the close of trade on Friday. Nike was up 4.27% and Bed Bath & Beyond gained 2.72%. Darden stock rose by 2.43% on June 26.

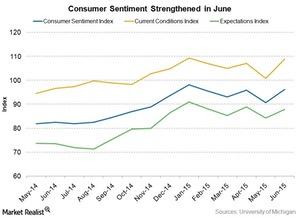

Consumer sentiment gained 5.4 points in June

The Consumer Sentiment Index is a monthly index that’s jointly released by the ISR (Institute for Social Research) of the University of Michigan and Thomson Reuters. It came out on Friday, June 26. The composite index stood at 96.1 index points in June—a 5.4 point rise from May’s 90.7 points. The reading came in well above the initial Reuters estimate of 94.6 points. US consumers saw their personal financial projections in a positive light. Also, US households are expecting the largest wage growth since the subprime crisis.

The current conditions component climbed to 108.9 points—an 8.1 point gain over May. The index’s expectations component also advanced by 3.6 points to 87.8. The overall report revealed positive consumer sentiment in June 2015.

Now, we’ll take a look at the Eurozone. The ECB’s (European Central Bank) monetary stimulus is helping revive the economy. It’s spurring growth and raising consumer confidence across the Eurozone nations. Italy is a classic example. We’ll discuss it in the next part of this series.