China’s Investment Data Down, Industrial Production Up in May

China’s industrial production grew by 6.1% year-over-year in May. Economists were expecting an increase of 6.0%. May’s growth is higher than the 5.9% year-over-year growth in April.

June 24 2015, Updated 4:06 p.m. ET

Industrial production and fixed-asset investment

Industrial output measures the output of businesses involved in the industrial sector of the economy, including manufacturing, mining, and utilities. Fixed-asset investment (or FAI) is a measure of capital spending. It refers to any investment in physical assets such as real estate infrastructure and machinery that’s held for more than one year.

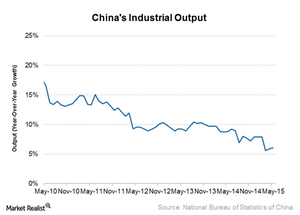

Industrial production up in May

According to monthly data released on June 10 by the National Bureau of Statistics of China, China’s industrial production grew by 6.1% year-over-year in May. Economists were expecting an increase of 6.0%. May’s growth is higher than the 5.9% year-over-year growth in April.

FAI grows at lowest rate in 15 years

China’s urban FAI continued to slow down in 2015 after declining in 2014. For the first five months of the year, FAI grew by just 11.4% compared to market expectations of 12%. This marks its lowest growth rate in almost 15 years.

Impact on companies

Industrial production and FAI are barometers of economic health. While industrial production showed continued strength, FAI indicated poor investment demand. Economists are expecting further easing measures by the Chinese government to spur business activity. Until then, weak investment demand and construction activity in China will continue to weigh down iron ore prices.

Iron ore prices affect companies such as Rio Tinto (RIO), BHP Billiton (BLT) (BHP), Vale SA (VALE), and Cliffs Natural Resources (CLF). They also affect the SPDR S&P Metals and Mining ETF (XME). RIO and BHP form 27.6% of the iShares MSCI Global Metals & Mining Producers ETF (PICK).