Understanding Canadian Solar’s Business Model

A significant proportion of Canadian Solar’s revenue comes from its top five customers, a structure that’s not uncommon in the industry.

Nov. 20 2020, Updated 5:12 p.m. ET

Revenue generation model

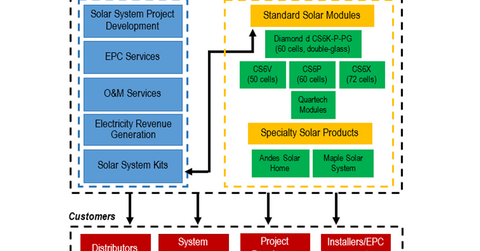

Canadian Solar (CSIQ) derives its revenues from two segments:

- the manufacturing segment, which is vertically integrated across the solar panel manufacturing value chain

- the total solutions segment, which is involved in downstream operations

Key customers

A significant proportion of Canadian Solar’s revenue comes from its top five customers, a structure that’s not uncommon in the industry. In 2014 this figure was 33.6%. It was 38.3% and 25.5% in 2013 and 2012, respectively.

The company’s notable customers in Canada include PennEnergy, Samsung (KRX), BlackRock (BLK), TransCanada (TRP-D), and BluEarth Renewables. Its customers in the United States include Duke Energy (DUK), Strata Energy Services, and Dominion (D). A key customer in Australia is Ikea.

Geographic spread of shipments

Canadian Solar has developed its geographic footprint and targets its products and services to customers across the globe. Whereas almost 90% of its revenue used to come from Europe until 2008, the company has shifted its focus to the Canadian and US markets while also expanding into emerging Asian markets.

Close competitors have also expanded their geographic footprints across the globe. Trina Solar (TSL) has the highest proportion of its sales in China (33%) and the United States (29%), SunPower (SPWR) the highest sales proportion in the Americas (77%), and JA Solar (JASO) in China (33%) and Japan (34%).

So how has Canadian Solar differentiated its business model? Read on to the next part of this series to learn more about the company’s manufacturing and downstream businesses.