Banks Set to Profit from Steepening Yield Curve

The yield curve has steepened a bit compared to where it was a week or even a month ago. Investors should consider the yield curve slope an indicator of bank performance.

June 16 2015, Published 9:08 a.m. ET

Ten-year bond yields rise sharply

Yields on ten-year US Treasury notes rose to 2.41% on June 5, 2015, up from 2.31% on June 4. The sharp rise was partly driven by strong US jobs data for May that had been released that same day. The jobs data gave investors an indication that the economy is probably back on track, which might make the Federal Reserve’s rate-hike decision easier.

The Fed is closely monitoring three economic variables as it considers its position on increasing the federal funds rate:

- GDP (gross domestic product)

- the unemployment rate

- inflation

The spike in US bond yields followed a similar development with the ten-year German bond yield. European quantitative easing has also contributed to the recent rise in US bond yields.

The slope of the yield curve

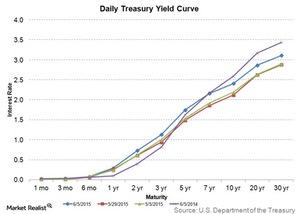

As the graph above shows, the yield curve has steepened a bit compared to where it was a week or even a month ago. Still, it’s flatter than it was a year ago.

While short-term interest rates are set by the Federal Reserve, longer-term rates are determined by the market. A rise in longer-term yields is generally an indication of an improving economy.

Lower economic growth expectations generally result in a flattened yield curve structure. Longer-term yields are also affected by long-term inflation expectations and central bank activities.

A steeper yield curve is good for banks

Banks typically borrow short term and lend longer term, which results in maturity transformation. The longer-term loans are funded in large part by shorter-term deposits. So banks gain from a steeper yield curve. A steep curve allows banks to lend on higher long-term rates and borrow on lower short-term rates. This boosts the banks’ margins.

A steeper curve could positively affect the performance of large and small banks alike, including KeyCorp (KEY), SunTrust Banks (STI), BB&T (BBT), and Regions Financial (RF).

Together, these four banks form ~5.5% of the SPDR S&P Regional Banking ETF (KRE). Investors should consider the yield curve slope an indicator of bank performance.