KeyCorp

Latest KeyCorp News and Updates

Banks Set to Profit from Steepening Yield Curve

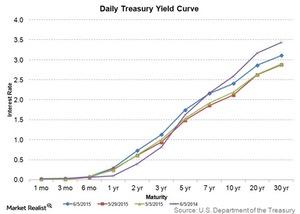

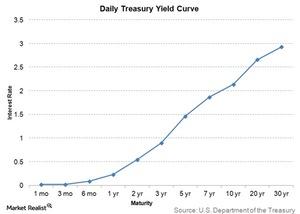

The yield curve has steepened a bit compared to where it was a week or even a month ago. Investors should consider the yield curve slope an indicator of bank performance.

Why Does a Flattened Yield Curve Hurt Banks?

Banks benefit from a steeper yield curve, which allows banks to lend on higher long-term rates and borrow on lower short-term rates. This boosts banks’ margins.