London Metal Exchange Copper Inventory Sees On-Warrant Stock Dip

A declining on-warrant copper inventory means that more metal is being booked for delivery. This is generally associated with stronger demand.

April 21 2015, Published 11:56 a.m. ET

Copper inventory

Total copper inventory with the LME (London Metal Exchange) stood at 0.33 million tons as of April 16. This is almost flat compared to inventory levels in March. LME copper inventory has almost doubled since the start of 2015. The current copper inventory at LME warehouses is the highest it’s been since January last year.

On-warrant inventory

All metal that enters the warehouses is on warrant. These are canceled when the warrant-bearer requests physical delivery. Then, warrants are no longer available for trading. It’s important to note that the warehoused inventory levels aren’t affected by cancelled warrants. Only the physical movement of the metal affects these levels.

You could also say that only the on-warrant metal is available for delivery. Instead of total copper inventory, it’s better to look at on-warrant copper inventory.

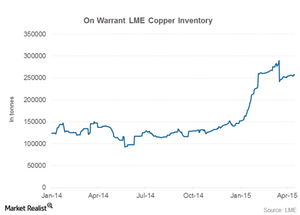

On-warrant stocks decline

The chart above shows the trend in on-warrant LME copper inventory. On-warrant copper stocks have come down ~12% in the last month. As of April 16, 76.14% of total LME copper inventory is on warrant, compared to 85% a month back. Nevertheless, the on-warrant stocks are almost double what they were in April 2014.

A declining on-warrant inventory means that more metal is being booked for delivery. This is generally associated with strong copper demand. Copper producers including Turquoise Hill Resources (TRQ), McEwen Mining (MUX), and Newmont Mining (NEM) benefit from higher copper demand. NEM currently forms 5.49% of the VanEck Vectors Gold Miners ETF (GDX). Barrick Gold (ABX) forms 6.77% of GDX.

Along with LME copper inventory, investors should track copper stocks in China. In the next part, we’ll analyze the latest trends in Chinese copper inventory.