Credit Default Swaps as Insurance against Junk Bond Market Crash

Carl Icahn mentions the use of credit default swaps as a form of protection against credit events. He implies that investors should possess sophisticated knowledge of the fixed income markets to enter that playing field.

Nov. 20 2020, Updated 2:34 p.m. ET

Oil price nosedive could trigger a crash in the junk bond markets

According to Sean Hanlon’s December 16, 2014, article Oil’s Price Decline Weighs On High Yield Debt in Forbes, US energy companies borrowed heavily using the junk bond market to finance hydraulic fracking operations. However, this occurred when oil prices were above the $100 per barrel level, resulting in an economically viable business model.

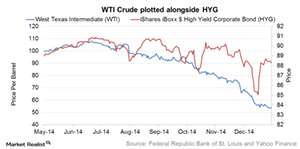

With the nosedive in oil prices in the latter half of 2014, the ability of these energy firms to retain their profitability was called into question—including their ability to service the payments on their high-yield debt.

As seen in the above graph, the prices of the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) declined with the fall in oil prices. With the looming uncertainty over oil prices, the times ahead are probably not bright for the high yield bond market.

Credit default swaps and a correction in high yield bonds

In the context of the high yield bond market, activist investor Carl Icahn mentions the use of credit default swaps as a form of protection or insurance against credit events. However, he terms these products as “arcane” and implies that investors should possess sophisticated knowledge of the fixed income markets to enter that playing field.

Credit default swaps (or CDS) are analogous to insurance contracts. The buyer of the CDS makes periodic fixed payments to the seller of the CDS, who receives these premiums and in exchange, compensates the buyer in the event of a default involving the underlying reference entity.

ProShares launched the ProShares CDS North American HY Credit ETF (TYTE) and the ProShares CDS Short North American HY Credit ETF (WYDE) in August 2014. Although TYTE offers investors a long exposure to North American high yield bonds, WYDE offers a short exposure to the same. For instance, investment in WYDE could hedge a portfolio of high yield bonds against a drop in prices. The decreased prices typically result from increasing defaults by energy firms due to falling oil prices.

In the final part of this series, we’ll discuss Carl Icahn’s view on the energy sector. The analysis specifically focuses on the outlook for oil companies such as EOG Resources (EOG), Exxon Mobil (XOM), Phillips 66 (PSX), and Valero Energy Corporation (VLO). Phillips 66 and Valero are oil refiners, EOG Resources is independent and lacks downstream operations, and Exxon Mobil is an integrated company.

EOG Resources has an 8.2% weight in the iShares US Oil & Gas Exploration & Production ETF (IEO). Phillips 66 has a 7.2% weight in IEO, and Valero has a 4.9% weight in IEO. EOG is also part of the iShares US Energy ETF (IYE), with a 3.1% exposure.