China’s Official PMI Holds above 50 for 2 Consecutive Months

While China’s official PMI held above 50 for two consecutive months, the PMI figures released by HSBC Markit paint a grim picture of China’s economy.

May 9 2015, Updated 1:06 a.m. ET

China official PMI

The construction sector is the largest consumer of steel in China (EWZ) (EWT). In our previous series, we discussed how most indicators of the Chinese real estate sector are trending downwards. In this part of the series, we’ll analyze the latest trend in China’s manufacturing PMI (purchasing managers’ index). The PMI is a key indicator of economic activity. Analysts track the PMI figures closely. It can give crucial insights into future GDP (gross domestic product) levels.

Official PMI above 50

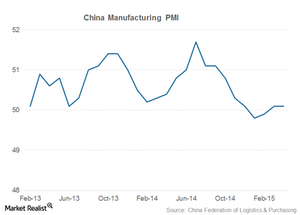

The previous chart shows the trends in China’s official PMI. As you can see, the PMI has been above 50 for two consecutive months. China’s official PMI in April was 50.1—it held above the crucial mark of 50. Readings above 50 generally indicate economic expansion, while readings below 50 indicate a contraction.

While China’s official PMI held above 50 for two consecutive months, the PMI figures released by HSBC Markit paint a grim picture of China’s economy. HSBC’s China PMI has been less than 50 for two months. It hit a one-year low of 48.9 in April.

Negative for the steel industry

The fall in China’s manufacturing PMI is a negative sign for the global steel industry. It signals a slowdown in industrial demand. The industrial sector is a major steel consumer in China. Mechel (MTL) has operations in China. ArcelorMittal (MT) also has a joint venture in China. A slowdown in Chinese steel demand would negatively impact ArcelorMittal.

The slowdown in Chinese steel demand led to higher levels of steel exports harming companies like Ternium S.A. (TX). The steel industry in Europe is also harmed by a higher level of Chinese steel imports. In the next part of this series, we’ll analyze the latest trend in the European steel industry.