Ternium SA

Latest Ternium SA News and Updates

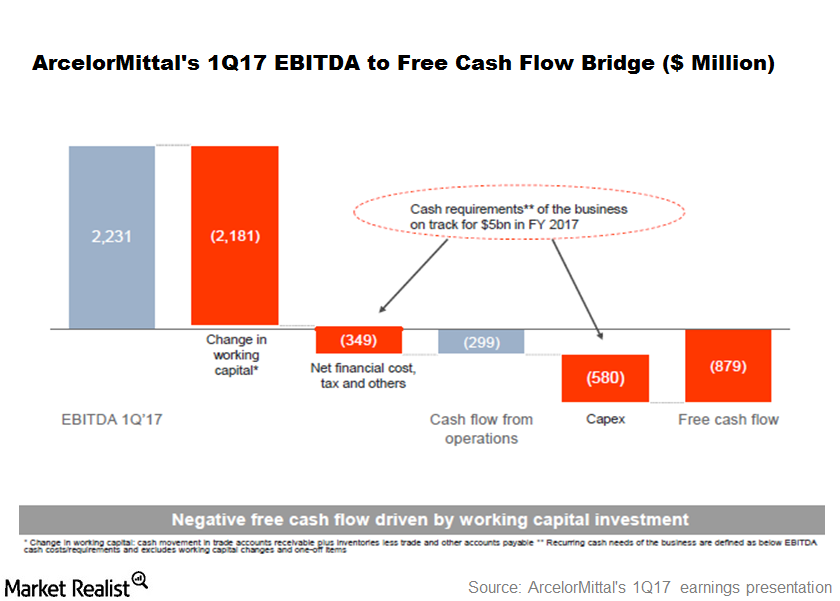

Why Investors Shouldn’t Fret over MT’s Negative Free Cash Flow

In this article, we’ll look at ArcelorMittal’s 1Q17 cash flow and leverage positions. As of the end of 1Q17, ArcelorMittal had net debt of $12.1 billion.

China’s Official PMI Holds above 50 for 2 Consecutive Months

While China’s official PMI held above 50 for two consecutive months, the PMI figures released by HSBC Markit paint a grim picture of China’s economy.