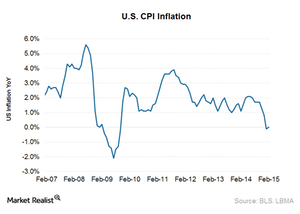

US CPI Inflation Sees Marginal Uptick in February

Gold usually has a direct relationship to inflation. Gold demand increases during periods of high inflation and falls when inflation is low.

April 20 2015, Published 12:42 p.m. ET

US inflation firming?

According to the report released by the US Bureau of Labor Statistics on March 24, the consumer price index (or CPI) for all urban consumers was flat year-over-year in February. The US CPI inflation reading for January was -0.1%. The slight rebound in February was due to a rise in gasoline prices for the first time since June.

Inflation hedge

Investors hold gold in their portfolios as an inflation hedge. Usually when inflation is high, the value of paper currency falls in terms of goods and services for which it can be exchanged. This leads investors to look for something that doesn’t lose its value.

Gold is a great alternative for this scenario, and gold usually has a direct relationship to inflation. Gold demand increases during periods of high inflation and falls when inflation is low.

So, on one hand, firming up of inflation is positive for gold, as investors view gold as an inflation hedge. On the other hand, as inflation inches up, it could bring the Fed rate hike forward, which will be negative for gold and gold stocks such as Gold Fields (GFI), AngloGold Ashanti (AU), Newmont Mining (NEM), Agnico Eagle Mines (AEM), and gold-backed ETFs such as the SPDR Gold Trust ETF (GLD) and the VanEck Vectors Gold Miners ETF (GDX).

Goldcorp makes up 7.6% of GDX, the largest percentage of the fund’s holdings. These ETFs invest in all of the stocks mentioned above.