Oaktree Capital Trades Key Positions in 4Q14

Oaktree Capital is an investment management firm that focuses on alternative markets. Store Capital (STOR) ranked among the fund’s top holdings in 4Q14.

April 3 2015, Published 3:09 p.m. ET

Oaktree Capital: An overview

Oaktree Capital is an investment management firm that focuses on alternative markets. Investment strategies used by Oaktree to manage funds apply to a wide range of asset classes ranging from corporate debt to listed equities. Oaktree’s mission is to offer highly professional management with a stress on risk control within a limited range of sophisticated investment techniques. The size of the fund’s portfolio increased from $6.04 billion in 3Q14 to $9.36 billion in 4Q14.

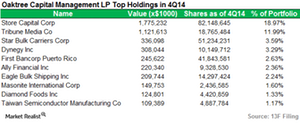

Top positions in 4Q14 portfolio

Store Capital (STOR) and Tribune Media (TRCO) ranked among the fund’s top holdings in 4Q14.

Key changes in 4Q14 portfolio

Oaktree Capital initiated new positions in Tribune Media (TRCO), Baidu (BIDU), and Store Capital (STOR). The fund sold its stakes in NetApp (NTAP), EMC (EMC), and Telefonica Brasil SA (VIV). The fund increased its positions in Dynegy (DYN), Ally Financial (ALLY), Itau Unibanco Holding SA (ITUB), and Taiwan Semiconductor Manufacturing (TSM). And, it lowered its holdings in American International Group (AIG), Yandex NV (YNDX), NRG Energy (NRG), and Mobile TeleSystems OJSC (MBT).

In the next part of this series, we’ll cover Oaktree’s new position in Tribune Media (TRCO). Tribune Media belongs to the consumer discretionary sector. For exposure to this sector, consider the Consumer Discretionary Select Sector SPDR Fund (XLY).