Newmont Will Release 1Q15 Results on April 24

Newmont Mining is the world’s second largest gold producer. It’s the only gold company included in the S&P 500 Index and Fortune 500.

April 21 2015, Updated 11:54 a.m. ET

Newmont to report 1Q15 earnings

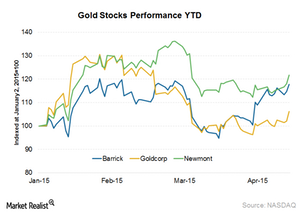

Newmont Mining (NEM) will declare its first quarter 2015 results on April 24, 2015. In this series, we’ll provide a preview of what to expect from the earnings. The preview will allow you to compare the company’s actual performance with the expectations.

4Q14 results recap

Newmont Mining’s results beat 4Q14 market expectations, primarily due to higher production and lower costs. Costs were aided by weaker oil prices and a weaker Australian dollar. Attributable production was 1.26 million ounces of gold in the fourth quarter, compared to 1.45 million ounces in the corresponding quarter last year. This was mainly due to the impact of divestments. All-in sustaining costs (or AISC) were $927 per gold ounce in the fourth quarter, down from $1,043 in the corresponding quarter last year. For detailed 4Q14 results, visit Newmont beats expectations in 2014.

Goldcorp (GG) missed its earnings expectations for 4Q14. It reported adjusted 4Q14 earnings per share (or EPS) of $0.07, missing consensus EPS of $0.10. The earnings miss was primarily due to the classification of pre-commercial production at both Cerro Negro and Eleonore.

Barrick Gold Corporation (ABX) had reported almost in-line results for 4Q14 and full-year 2014. The company’s 4Q14 operating earnings per share (or EPS) was $0.15, which was above the consensus estimate of $0.13. Barrick Gold’s gold production was in line with market expectations at 6.25 million ounces at all-in sustaining costs (or AISC) of $864 per ounce in 2014.

Company overview

Newmont Mining is the world’s second largest gold producer. It’s the only gold company included in the S&P 500 Index and Fortune 500. Newmont is engaged in the exploration and acquisition of gold and copper properties. It has operations in the US, Australia, Peru, Indonesia, Ghana, New Zealand, and Mexico.

Investors can gain access to the gold industry through gold-backed ETFs like the SPDR Gold Trust (GLD) and the VanEck Vectors Gold Miners ETF (GDX). GDX invests in the three stocks mentioned above. Combined, these stocks account for 20% of GDX’s holdings.