What Are Market Expectations for Newmont in 1Q15?

Analysts’ sales estimate for Newmont is $1.93 billion for 1Q15 compared to $1.80 billion in 4Q14.

April 27 2015, Updated 3:06 p.m. ET

Reviewing 1Q15

1Q15 hasn’t been a good quarter for the gold sector and gold stocks. Newmont Mining has lost 7% of its value since its fiscal 2014 results on February 19, 2015. In the same period, gold prices have declined by 1.4%. Prices were impacted by various factors, including appreciation in the US dollar and the Federal Reserve rate hike expectation.

Barrick Gold’s (ABX) share price increased by 2.8% after its 4Q14 earnings, while that of Goldcorp (GG) declined by 6.2%.

Newmont, Goldcorp, and Barrick form ~20% of the VanEck Vectors Gold Miners ETF (GDX), while the SPDR Gold Trust ETF (GLD) provides exposure to spot gold prices.

The analysts’ estimates

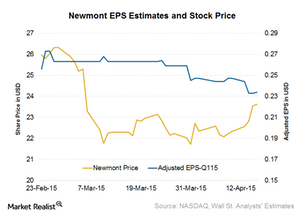

Market expectations for Newmont Mining (NEM) are varied. Of the analysts covering Newmont, five analysts give a buy ranking, 15 have a hold ranking, and two have sell recommendations for the stock. Thus the consensus forecast suggests investors should hold their positions in the company. Analysts’ average target price is $26.41.

Analysts’ sales estimate for Newmont is $1.93 billion for 1Q15 compared to $1.80 billion in 4Q14. Analysts’ estimate for adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) for 1Q15 is $627.4 million, compared to $504 million for 3Q14.

The current Wall Street analysts’ earnings per share (or EPS) estimate for Newmont 1Q15 is $0.226 per share.

The company beat estimates five out of the last eight times, including with its 4Q14 results and with its fiscal 2014 results. The better-than-expected fiscal 2014 was primarily due to higher production and lower costs. The share price reacted positively to the company beating expectations. After 4Q14 results came out, Newmont’s share price increased by 4.6%.

Company’s guidance

Newmont upgraded its 2015 guidance when it released its fiscal 2014 results. The company raised the production guidance from 4.5 million to 4.75 million ounces to 4.6 million to 4.9 million ounces. The company lowered its all-in sustaining costs for gold from $1,000 per ounce to $1,080 per ounce down to $960 per ounce to $1,020 per ounce.