The Kraft–Heinz Merger: Transaction Rationale

The Kraft–Heinz merger entity will maintain Kraft’s current dividend, and management anticipates it will grow.

April 9 2015, Updated 1:54 p.m. ET

This deal is about synergies and efficiencies

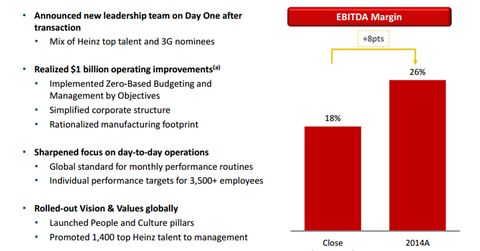

Berkshire Hathaway (BRK-B) and 3G Capital bought Heinz in 2013, engaging to turn it around. By instituting efficiencies, zero-based budgeting, and other operational initiatives, the consortium was able to generate $1 billion annually in improvements. This took Heinz’s EBITDA margins from 18% to 26%, which is significant movement.

The combined company will also extract value by refinancing existing debt into investment-grade paper. Since the $16.50 per share special dividend is paid for by Berkshire Hathaway and 3G’s equity investment, there won’t be much in the way of extra leverage. But some Kraft preferred stock will be retired and replaced with debt.

The companies expect to generate $1.5 billion in synergies by 2017. The Kraft–Heinz merger entity will maintain Kraft’s current dividend, and management anticipates it will grow. Big mature defensive stocks like Kraft are generally slow growers, and dividends provide an important part of the return for investors.

This deal is a way for Berkshire and 3G to monetize their holdings

This transaction gives Berkshire Hathaway and 3G capital a way to get a stock listing for their Heinz holding. Typically, a private equity firm needs to sell the company or launch an IPO (initial public offering) in order for the investor to monetize—and eventually exit—their position.

Merger arbitrage resources

Other important merger spreads include the deal between Time Warner Cable (TWC) and Comcast (CMCSA) as well as the merger between Pharmacyclics (PCYC) and AbbVie (ABBV). For a primer on risk arbitrage investing, read Merger arbitrage must-knows: A key guide for investors.

Investors who are interested in trading in the consumer discretionary sector should look at the Consumer Staples Select Sector SPDR Fund (XLP) or the iShares Global Consumer Staples ETF (KXI).