The Kraft–Heinz Merger: Transaction Benefits for Kraft Investors

Kraft has a non-solicitation agreement with a fiduciary out. This means that Kraft could discuss another merger if approached by another suitor.

April 6 2015, Updated 3:08 p.m. ET

Basics of the transaction

The Kraft–Heinz merger is a transaction that will see Kraft (KRFT) merged with Heinz, which is owned by Berkshire Hathaway (BRK-B) and 3G Capital.

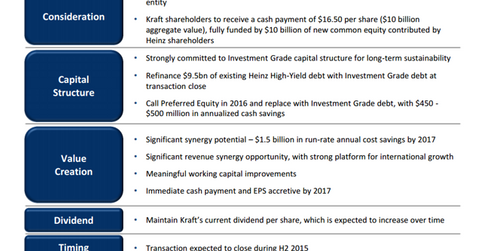

Terms of the transaction

Under the terms of the deal, Kraft shareholders will receive a special dividend of $16.50 per share and new stock in the merged entity. Kraft shareholders will own 49% of the new entity, while Berkshire and 3G will own the balance.

Conditions precedent

The following conditions need to be satisfied in order for the deal to close:

- Kraft shareholder vote

- Hart-Scott-Rodino antitrust filing

- required foreign regulatory approvals

- U.S. Securities and Exchange Commission approval of the proxy statement

Non-solicitation

Kraft has a non-solicitation agreement with a fiduciary out. This means that prior to shareholder approval of the transaction, Kraft could discuss another merger if approached by another suitor.

First, the Kraft board of directors would have to determine that such discussions could lead to a bona fide offer, and that such an offer would likely result in a higher bid for the company. Kraft, however, is not permitted to shop itself around.

Breakup fee

In the event another bidder comes in and tops the consortium bid, Kraft will owe a breakup fee of $1.2 billion.

Financing

Berkshire and 3G will make an equity investment of $10 billion that will fund the special dividend.

Merger arbitrage resources

Other important merger spreads include the deal between Time Warner Cable (TWC) and Comcast (CMCSA) as well as the merger between Pharmacyclics (PCYC) and AbbVie (ABBV). For a primer on risk arbitrage investing, read Merger arbitrage must-knows: A key guide for investors.

Investors who are interested in trading in the consumer discretionary sector should look at the Consumer Staples Select Sector SPDR Fund (XLP) or the iShares Global Consumer Staples ETF (KXI).