IDRs: How Do They Impact MLPs?

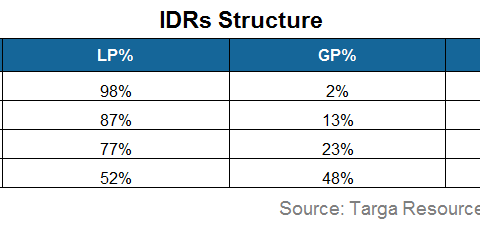

IDRs entitle the GP to receive a higher percentage of incremental cash distributions after certain target distribution levels have been achieved for the LP unitholders.

April 13 2015, Updated 11:05 p.m. ET

Overview of IDRs

IDRs (incentive distribution rights) entitle the GP (general partner) to receive a higher percentage of incremental cash distributions after certain target distribution levels have been achieved for the LP (limited partner) unitholders. This affects the “cost of equity,” or how much return unitholders demand.

The above table summarizes the distribution tier structure at Targa Resources Partners (NGLS).

The consequence of IDRs’ is that an MLPs’ (master limited partnerships) excess cash flow must grow at larger rates than distributions to LP unitholders. For example, let’s say there’s an MLP with the IDR structure that reached the higher tier splits. It wants to grow its distributions to LP unitholders by 5%. This means that the MLP must grow its available cash flow by more than 5% because the GP owners will be taking a larger share of the incremental cash flow growth.

So, while the GP technically doesn’t have any legal fiduciary duty to the LP, there’s an alignment of interests between GPs and LPs. Both of them want to see LP distributions grow steadily over time.

Before buying MLP stock, investors might be want to understand the stock’s IDR structure. This information can be found in the company filings—like 10-K, 10-Q, and the prospectus supplement for new equity issuance.

Key ETFs and stocks

Not all MLPs have IDRs. For example, MarkWest Energy Partners (MWE), Enterprise Products Partners (EPD), and Buckeye Partners (BPL) don’t have IDRs. Most of the holdings of the Alerian MLP ETF (AMLP) have IDRs.

In the next part of this series, we’ll discuss why distributions are important for a MLP investor.