Magnetar Capital Initiated New Positions in 4Q14

Magnetar Capital was established in 2005 by Alec Litowitz and Ross Laser. Currently, the hedge fund manages assets in excess of $12 billion.

April 13 2015, Published 8:41 a.m. ET

Magnetar Capital

Established in 2005 by Alec Litowitz and Ross Laser, Magnetar Capital has grown by more than five times—in terms of assets under management—since its foundation. Currently, the hedge fund manages assets in excess of $12 billion. It seeks to generate active returns through deploying its global event-driven, fixed income, and energy strategies across multiple asset classes.

Top holdings

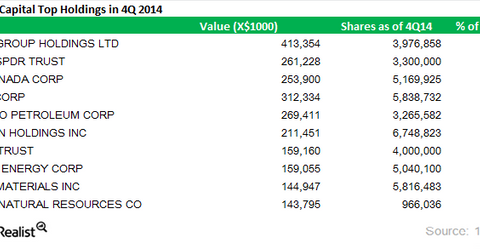

The above table summarizes the fund’s top holdings at the end of the fourth quarter.

Magnetar’s portfolio remained highly concentrated in energy stocks. They represented over 60% of its 4Q14 US long portfolio value. Investors seeking to gain exposure to the energy sector can consider an ETF like the Energy Select SPDR Fund (XLE). XLE’s portfolio is comprised of 44 energy and utilities stock that best represent the energy sector of the S&P 500. Other alternatives to XLE include the iShares US Energy ETF (IYE) and the Vanguard Energy ETF (VDE) which attempt to effectively track the performance investable US energy stocks.

Magnetar’s new stakes in the fourth quarter

Magnetar Capital’s US long portfolio size increased 10.1% from $4.93 billion in 3Q14 to reach $5.43 billion by the end of the year. The fund undertook several new positions. The notable exposures added during the fourth quarter include Devon Energy (DVN), Applied Materials (AMAT), Restaurant Brands International (QSR), and McDonald’s (MCD).

In the next part of this series, we’ll cover the fund’s new stake in Devon Energy.