Analyzing Cheniere Energy Partners’ Historical Performance

For 1Q15, analysts are expecting Cheniere Energy Partners’ revenue to come in at $67.1 million. The loss per share estimates have been pegged at -$0.113.

April 23 2015, Published 11:38 a.m. ET

1Q15 estimates

For 1Q15, analysts are expecting Cheniere Energy Partners’ (CQP) revenue to come in at $67.1 million. The loss per share estimates have been pegged at -$0.113.

Quarterly revenue

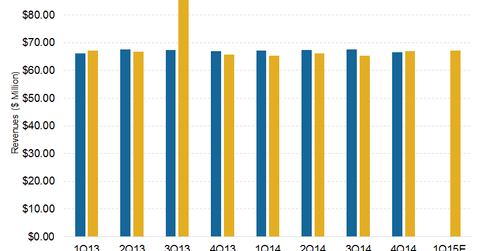

From 1Q13 to 4Q14, Cheniere Energy Partners’ quarterly revenue was mainly in line if not more than the market expectations.

During this period, the quarterly revenue barely increased by 0.7%. However, from 1Q14 to 4Q14, the quarterly revenue fell by ~1%.

The 1Q15 revenue estimate of $67.1 million is 0.8% higher than the previous quarter’s revenue. It’s ~0.2% higher than the revenue for the same quarter last year.

Earnings per share

From 1Q13 to 4Q14, Cheniere Energy Partners’ EPS (earnings per share) was mainly negative.

However, from 1Q14 to 4Q14, the quarterly losses per share reduced by ~82%.

The 1Q15 loss per share estimate of -$0.113 is 88% higher than the losses per share in the previous quarter. It’s ~67% lower than the loss per share for the same quarter last year.

Background

Cheniere Energy Partners is a publicly traded MLP (master limited partnership). It was created by Cheniere Energy (LNG). Cheniere Energy owns 100% of Cheniere Energy Partners’ general partner—Cheniere Energy Partners GP, LLC. Cheniere Energy is part of the iShares U.S. Energy ETF (IYE). It accounts for 1.01% of IYE.

Other US LNG (liquefied natural gas) exporters include Chevron (CVX) and Sempra Energy (SRE).