A summary of Caxton Associates’ key 4Q14 holdings

Caxton Associates’ portfolio fell from $3.04 billion in 3Q14 to $1.29 billion in 4Q14.

March 4 2015, Published 12:39 p.m. ET

An overview of Caxton Associates

Caxton Associates is an investment and trading firm based in New York. The primary business of the firm is to manage proprietary and client capital via “global macro hedge fund strategies”. The firm offers services for pooled investment vehicles and manages and launches hedge funds for clients.

Caxton Associates invests in alternative investments, and fixed income and equity markets throughout the world. The fund uses strategies such as equity long only, equity long/short, and global macro.

Caxton Associates’ updated positions

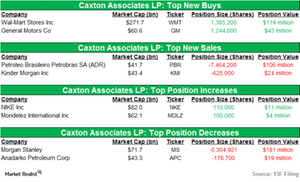

Caxton Associates disclosed new positions, sales in existing positions, and changes in its other positions within its 4Q14 portfolio through its recent 13F filing. The above table shows the major changes in the firm’s positions.

The top holdings in Caxton Associates’ 4Q14 portfolio

Caxton Associates’ portfolio fell from $3.04 billion in 3Q14 to $1.29 billion in 4Q14. The following table summarizes the top holdings of the firm in 4Q14.

Key 4Q14 position changes for Caxton Associates

Caxton Associates initiated new positions in Walmart (WMT) and General Motors (GM), and sold its stakes in Kinder Morgan (KMI) and Petroleo Brasileiro Petrobras SA (American Depository Receipt) (PBR). The fund increased its holdings in NIKE (NKE) and Mondelez International (MDLZ), and lowered its holdings in Morgan Stanley (MS) and Anadarko Petroleum (APC). The fund also lowered its holdings significantly in the Financial Select Sector SPDR ETF (XLF).

The next article in this series will discuss Caxton’s new position in Walmart.