What Are Starwood’s Revenue Sources?

The revenue from owned, leased, and consolidated joint ventures is primarily derived from hotel operations. This includes room rentals and food and beverage sales.

April 1 2015, Updated 11:05 a.m. ET

Revenue sources

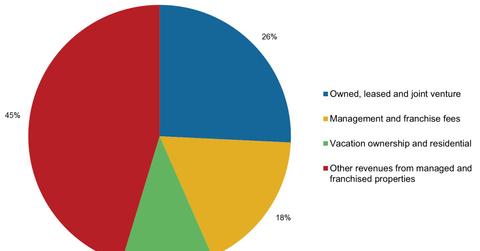

Starwood Hotels and Resorts (HOT) gets its revenue from a series of sources:

- hotels and resorts at owned, leased, and consolidated joint venture properties

- management fees and franchise fees

- vacation ownership and residential sales

- other revenue from managed and franchised properties

Now, we’ll take a closer look at each of these sources.

Owned, leased, and consolidated joint ventures

Revenue from this source is primarily derived from hotel operations. This includes room rentals and food and beverage sales. RevPAR (revenue per available room) is a leading revenue indicator for hotel companies like Starwood, Marriott (MAR), Hilton (HLT), and Wyndham (WYN).

RevPAR measures the growth in rooms’ revenue for comparable properties over certain periods. We’ll discuss this indicator in more detail later in this series. Some of these companies are part of ETFs like the iShares U.S. Consumer Services (IYC), the PowerShares Dynamic Leisure and Entertainment Portfolio (PEJ), and the Consumer Discretionary Select Sector SPDR Fund (XLY).

Management fees and franchise fees

Revenue generated from this source represents fees earned on hotels and resorts managed worldwide—usually under long-term contracts. Management fees are comprised of a base fee. They’re based on a percentage of gross revenue. Incentive fees are generally based on the property’s profitability. Franchise fees are generally based on a percentage of hotel room revenue.

Vacation ownership and residential sales

The vacation ownership and residential segment generates its revenue through the acquisition, development, and operation of vacation ownership resorts, marketing and selling of VOIs (vacation ownership interests), and residential units. It also provides finance to customers who purchase such interests.

Other revenue from managed and franchised properties

Revenue from this segment represents reimbursements of costs incurred on behalf of managed hotel properties and franchisees. Since the reimbursements are made based on the costs incurred with no added margin, revenue from this segment and the corresponding expenses don’t impact Starwood’s operating income or net income.